What is the Accounting Equation?

Contents

The accounting equation, also called the basic accounting equation, forms the foundation for all accounting systems. In fact, the entire double entry accounting concept is based on the basic accounting equation. This simple equation illustrates two facts about a company: what it owns and what it owes.

The accounting equation equates a company’s assets to its liabilities and equity. This shows all company assets are acquired by either debt or equity financing. For example, when a company is started, its assets are first purchased with either cash the company received from loans or cash the company received from investors. Thus, all of the company’s assets stem from either creditors or investors i.e. liabilities and equity.

Basic Accounting Equation Formula

Here is the basic accounting equation.

As you can see, assets equal the sum of liabilities and owner’s equity. This makes sense when you think about it because liabilities and equity are essentially just sources of funding for companies to purchase assets.

The equation is generally written with liabilities appearing before owner’s equity because creditors usually have to be repaid before investors in a bankruptcy. In this sense, the liabilities are considered more current than the equity. This is consistent with financial reporting where current assets and liabilities are always reported before long-term assets and liabilities.

This equation holds true for all business activities and transactions. Assets will always equal liabilities and owner’s equity. If assets increase, either liabilities or owner’s equity must increase to balance out the equation. The opposite is true if liabilities or equity increase.

Now that we have a basic understanding of the equation, let’s take a look at each accounting equation component starting with the assets.

Accounting Equation Components

Assets

An asset is a resource that is owned or controlled by the company to be used for future benefits. Some assets are tangible like cash while others are theoretical or intangible like goodwill or copyrights.

Another common asset is a receivable. This is a promise to be paid from another party. Receivables arise when a company provides a service or sells a product to someone on credit.

All of these assets are resources that a company can use for future benefits. Here are some common examples of assets:

- Current Assets

- Cash

- Accounts Receivable

- Prepaid Expense

- Fixed Assets

- Vehicle

- Buildings

- Intangible Assets

- Goodwill

- Copyrights

- Patents

Liabilities

A liability, in its simplest terms, is an amount of money owed to another person or organization. Said a different way, liabilities are creditors’ claims on company assets because this is the amount of assets creditors would own if the company liquidated.

A common form of liability is a payable. Payables are the opposite of receivables. When a company purchases goods or services from other companies on credit, a payable is recorded to show that the company promises to pay the other companies for their assets.

Here are some examples of some of the most common liabilities:

- Accounts payable

- Bank loans

- Lines of Credit

- Personal Loans

- Officer Loans

- Unearned income

Equity

Equity represents the portion of company assets that shareholders or partners own. In other words, the shareholders or partners own the remainder of assets once all of the liabilities are paid off.

Owners can increase their ownership share by contributing money to the company or decrease equity by withdrawing company funds. Likewise, revenues increase equity while expenses decrease equity.

Here are some common equity accounts:

- Owner’s Capital

- Owner’s Withdrawals

- Officer Loans

- Unearned income

- Common stock

- Paid-In Capital

Example

How to use the Accounting Equation

Let’s take a look at the formation of a company to illustrate how the accounting equation works in a business situation.

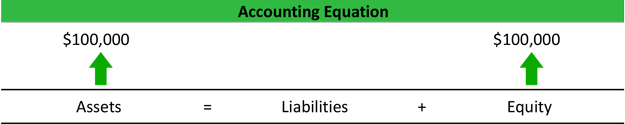

Ted is an entrepreneur who wants to start a company selling speakers for car stereo systems. After saving up money for a year, Ted decides it is time to officially start his business. He forms Speakers, Inc. and contributes $100,000 to the company in exchange for all of its newly issued shares. This business transaction increases company cash and increases equity by the same amount.

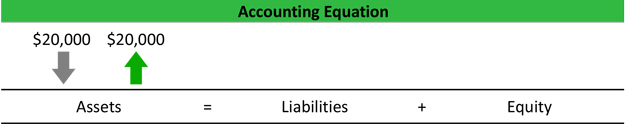

After the company formation, Speakers, Inc. needs to buy some equipment for installing speakers, so it purchases $20,000 of installation equipment from a manufacturer for cash. In this case, Speakers, Inc. uses its cash to buy another asset, so the asset account is decreased from the disbursement of cash and increased by the addition of installation equipment.

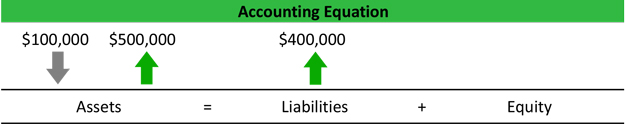

After six months, Speakers, Inc. is growing rapidly and needs to find a new place of business. Ted decides it makes the most financial sense for Speakers, Inc. to buy a building. Since Speakers, Inc. doesn’t have $500,000 in cash to pay for a building, it must take out a loan. Speakers, Inc. purchases a $500,000 building by paying $100,000 in cash and taking out a $400,000 mortgage. This business transaction decreases assets by the $100,000 of cash disbursed, increases assets by the new $500,000 building, and increases liabilities by the new $400,000 mortgage.

As you can see, all of these transactions always balance out the accounting equation. This is one of the fundamental rules of accounting. The accounting equation can never be out of balance. Assets will always equal liabilities and owner’s equity.