What is the Income Summary Account?

The income summary account is a temporary account used to store income statement account balances, revenue and expense accounts, during the closing entry step of the accounting cycle. In other words, the income summary account is simply a placeholder for account balances at the end of the accounting period while closing entries are being made.

At the end of each accounting period, all of the temporary accounts are closed. You might have heard people call this “closing the books.” Temporary accounts like income and expenses accounts keep track of transactions for a specific period and get closed or reset at the end of the period. This way each accounting period starts with a zero balance in all the temporary accounts, so revenues and expenses are only recorded for current years.

How to Close an Account into Income Summary

There are two ways to close temporary accounts. You can either close these accounts directly to the retained earnings account or close them to the income summary account.

Closing temporary accounts to the income summary account does take an extra step, but it also provides and an audit trail showing the revenues, expenses, and net income for the year.

Once the temporary accounts are closed to the income summary account, the balances are held there until final closing entries are made. This provides a useful check for errors. Once all the temporary accounts are closed, the balance in the income summary account should be equal to the net income of the company for the year.

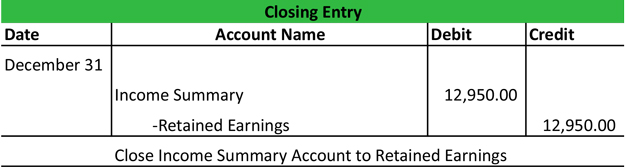

Then the income summary account is zeroed out and transfers its balance to the retained earnings (for corporations) or capital accounts (for partnerships). This transfers the income or loss from an income statement account to a balance sheet account. This is the only time that the income summary account is used. For the rest of the year, the income summary account maintains a zero balance.

Example

After Paul’s Guitar Shop prepares its closing entries, the income summary account has a balance equal to its net income for the year. This balance is then transferred to the retained earnings account in a journal entry like this.

After this entry is made, all temporary accounts, including the income summary account, should have a zero balance.

Now that Paul’s books are completely closed for the year, he can prepare the post closing trial balance and reopen his books with reversing entries in the next steps of the accounting cycle.