Definition: The accrual accounting rate of return takes the accounting rate of return calculation and applies the accrual method of accounting. This means that the income from the investment is recognized on the accrual basis. In other words, the income is recognized when it is earned not when it is received.

What Does Accrual Accounting Rate of Return Mean?

Most people and companies have some types of investments. Whether the investments are short-term CDs or long-term retirement plans, investments play a big role in Americans’ lives. The only way to tell whether an investment is worthwhile or not is to measure the return or amount of money the investment has made. In accounting, we call this measurement the accounting rate of return.

Example

For example, if you own a bond that pays interest on the last day of the month and day of March is on a Sunday, the interest might be paid in the month of March. It will probably get paid on the first of April. The accrual basis of accounting would recognize that income in the month of March because it was earned in March even though it wasn’t actually received until April.

Just like the accounting rate of return, the accrual accounting rate of return usually uses annual or annual average income and investment numbers. Monthly and weekly number can also be used for specific purposes.

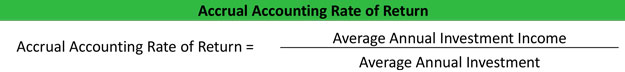

Here is how the accrual accounting rate of return is calculated: