Definition: Hedge Fund of funds (FOF), also known as a collective investment or multi-manager investment, is a hedge fund strategy that allows hedge fund managers to construct a diversified portfolio of different investment funds.

What Does Fund of Funds Mean?

What is the definition of fund of funds? In fact, depending on the client’s investor profile and level of risk tolerance, hedge fund managers allocate investment capital over individual funds with a different risk and different market exposure. In doing so, they capitalize on the diversification offered by investing directly into different funds.

In addition, the fund of hedge funds strategy allows fund managers to use different management strategies (multi-strategy fund), thereby combining equity long/short, convertible bond arbitrage, statistical arbitrage, and merger arbitrage strategies in 20 to 30 different hedge funds, or a single management strategy (single-strategy fund). On the downside, because the strategy comes with an added level of management, it incurs higher fees.

Let’s look at an example.

Example

Jill is a fund manager in an investment bank. She follows a wide variety of individual funds, and she implements the appropriate hedge fund strategy to ensure capital protection and profit generation for her clients.

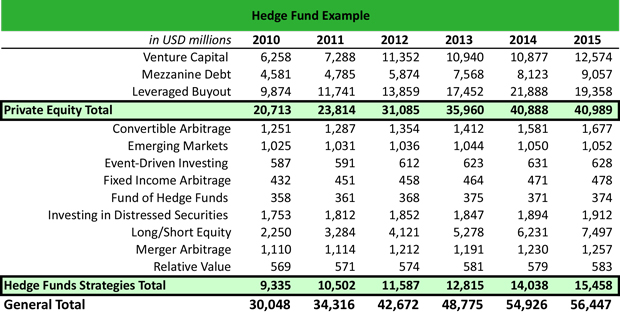

Jill has created an Excel spreadsheet with a client’s portfolio to determine which funds she should use in a multi-strategy fund as part of a fund of hedge funds strategy.

Jill can change the allocation of capital if the market conditions change. A single-strategy fund, typically, invests in no more than three different funds. The funds are locked up for a given amount of time, and they offer diversified exposure while leveraging risk. Also, because Jill uses a variety of different strategies, the portfolio is highly diversified and has lower minimums.

Summary Definition

Define Hedge Fund of Funds: FOF means an investment strategy where portfolios are constructed with many different types of assets: stocks, bonds, and of instruments.