Definition: The levered free cash flow represents the amount of cash available to shareholders after the company has paid all its short-term and long-term obligations.

What Does Levered Free Cash Flow Mean?

What is the definition of levered free cash flow? The levered free cash flow is an important measure of a firm’s ability to grow. When a firm seeks expansion into a new market or the development of a new product, it needs additional cash. Small businesses are often capable of financing their operations without raising additional capital. However, larger firms need to raise additional capital through equity financing, i.e. their investors, or debt financing, i.e. through a bank to help their business grow.

Businesses that generate strong LFCF are financially healthy because they are able to cover their obligations, distribute dividend payments and grow. Conversely, a weak or negative LFCF indicates that the company generates insufficient cash to cover all its financial obligations. To calculate the LFCF, we need to know the cash flow from operation (OCF), the capital expenditures (CapEx), the interest income and the interest expenses.

Let’s look at an example.

Example

John is an investment analyst, and he follows the pharmaceutical sector. Lately, some of the companies in the portfolio of stocks that he manages for his clients, are underperforming the sector, and John wants to find an explanation for their weak performance. One of the companies has recently released quarterly financial results, and unlike what investors and analysts expected, the results were below expectations.

John creates an Excel spreadsheet to calculate the LFCF of the firm and determine its ability to grow. First, he uses the items for the calculation of the firm’s operating cash flow (OCF):

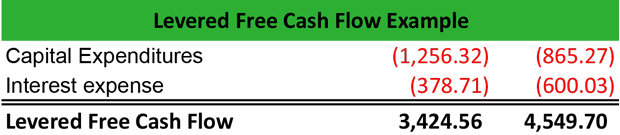

Then, he identifies the interest expense on the income statement and the capital expenditures on the cash flow statement. Now, John can calculate the levered free cash flow as follows:

The levered cash flow decreased by 24.7% YoY due to a decrease in net income by 36.9%, and an increase in capital expenditures by 45.2%. If the company seeks to grow, it should increase its sales, reduce its capital expenditures and generate a stronger net income that will allow the firm to be competitive but also to fund and expand its operations.

Summary Definition

Define Levered Free Cash Flows: LFCF means the money that is available to stockholders after debt servicing.