Definition: Multiple is a performance measure, which is used in the valuation of a firm’s financial health and performance.

What Does Multiple Mean?

What is the definition of multiple? Financial analysts use multiple analysis to determine the financial performance and solvency of a firm. In stock valuation, using the ‘multiple method’ allows an analyst to compare the company’s metrics relative to its sales or earnings; hence, the multiple valuation is also known as relative valuation.

In addition, in the relative valuation model, financial analysts are converting the market values into standardized values to perform the comparison and identify potential differences between firms that operate in the same industry. At the end of the day, relative valuation is used to determine whether a stock is under- or overvalued.

Let’s look at an example.

Example

Company ABC is a retailing company that sells sports goods. Its stock currently trades at $45.64, and the company’s EPS is $3.77. Company XYZ is a retailer that sells sports equipment. Its stock currently trades at $52.37 and its EPS is $3.05.

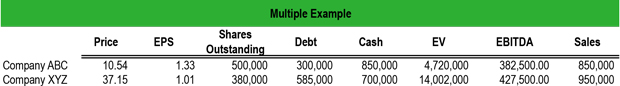

Mark is a financial analyst, and he wants to determine whether the stocks are overvalued or undervalued relative to the market. Mark creates an Excel spreadsheet to calculate price-to-earnings (P/E), enterprise value-to-EBITDA (EV/EBITDA), and enterprise value-to-sales (EV/Sales). Both companies have no minority interest or preferred shares; therefore, their enterprise value is equal to their capitalization plus debt minus cash.

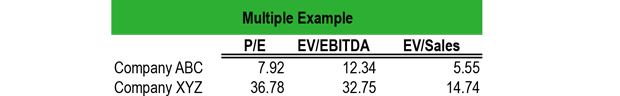

Based on the above inputs, Mark calculates P/E, EV/EBITDA, and EV/Sales:

The market P/E for the retail sector is 33.30, the market EV/EBITDA is 7.92, and the EV/Sales is 0.64. Therefore, compared to the market average, Company ABC is undervalued and Company XYZ is overvalued.

Summary Definition

Define Multiples: A multiple means a financial method for analyzing a company’s financial performance and evaluating its overall value.