Definition: Negative working capital occurs when a firm’s current liabilities are greater than its current assets, thereby requiring the firm to raise additional capital to meet its debt obligations.

What Does Negative Working Capital Mean?

What is the definition of negative working capital? Negative working capital is the negative difference between the current assets and the current liabilities, suggesting that the current liabilities have covered the current assets by more than 100%. Therefore, in the case of a negative WC, the working capital ratio is lower than 1, indicating that the company faces a difficulty in meeting its financial obligations.

Especially, when a potential merger or acquisition is about to take place, the acquiring company seeks for a working capital ratio higher than 1 to feel safe that the target company can meet its short-term obligations. Although a negative WC is widely considered as a negative sign, the case of companies that raised capital upfront such as Dell proves that there is a positive side in every situation.

Let’s look at an example.

Example

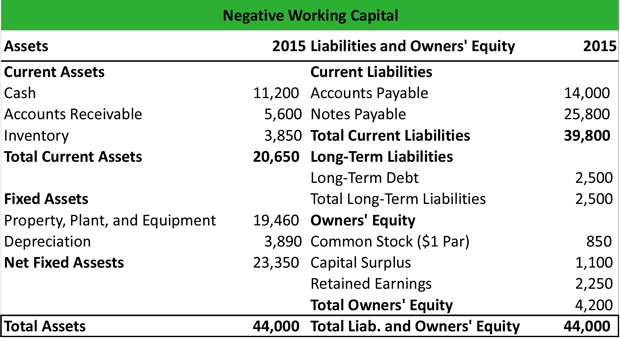

Company X is a manufacturing company that operates two manufacturing plants in the Midwest. The company is facing liquidity problems and a difficulty to cover its short-term liabilities. More specifically, its current assets are not sufficient to cover its current liabilities, and the company has a negative WC of $20,650 – $39,800 = -19,150.

Consequently, its working capital ratio is current assets / current liabilities = $20,650 / $39,800 = 0.52 < 1.

Based on the company’s balance sheet, there is an immediate need to raise its account receivables in order to increase its total current assets. In addition, the company should revisit its credit policy with the aim of collecting more money from its debtors. A tighter credit policy will increase the account receivables, and the company will be able to face its short-term obligations.

Consequently, on the Liabilities section, the accounts payable and the notes payable will be potentially lowered, allowing for a higher working capital ratio.

Summary Definition

Define Negative Working Capital: NWC means a company has more current liabilities than current assets on its balance sheet.