Definition: Net assets are more commonly referred to as equity. This is the amount of retained earnings that are left in the business. In other words, the retained earnings or profits made by the company are not distributed to the owners. The profits are left in the business to help it grow.

What Does Net Assets Mean?

Net assets means the same thing as equity with a slight twist. Net assets refers to equity as the amount of the business the owners actually own. It’s the owners’ claim to the assets of the company.

Example

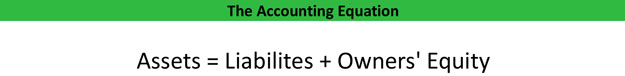

The term net assets comes from the accounting equation. As you can see, the assets of a company are equal to the liabilities and owners’ equity.

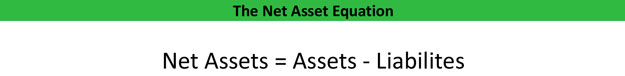

If you move the liabilities over to the assets side of the accounting equation, you will get the net assets equation.

Now you can see that the assets net of the liabilities equal the owner’s equity. Essentially, the stockholders of the business own the assets that don’t have outstanding loans. It’s just like a house with a mortgage on it. Your equity or net assets in the house is the value of the house minus the outstanding mortgage. Net assets is the same concept.

Owners can increase their net assets in a few different ways. They can make additional investments in the company or owners can simply leave excess profits in the company’s bank account rather than calling a dividend or distribution. If shareholders or owners take money out of the business in the form of a dividend or distribution, their nets assets decrease. The ratio of liabilities to assets goes up because the owners just took cash, an asset, out of the business.