Definition: Operating income before depreciation & amortization (OIBDA) is a non-GAAP financial metric of a firm’s operating efficiency that calculates a firm’s income in a given period without taking into account its tax structure and capital spending.

What Does OIBDA Mean?

What is the definition of OIBDA? A high operating income indicates that the firm generates cash to cover its working capital and debt needs. To have a clear picture of a firm’s operating income, analysts calculate a firm’s operating income excluding depreciation and amortization expenses, which are then added back to the calculation of the OIBDA along with interest and tax expenses. OIBDA tends to provide a better indication of income from a firm’s core operations, thus providing investors with a better idea of how efficiently a firm operates based on its ability to produce and sell its products or services.

Let’s look at an example.

Example

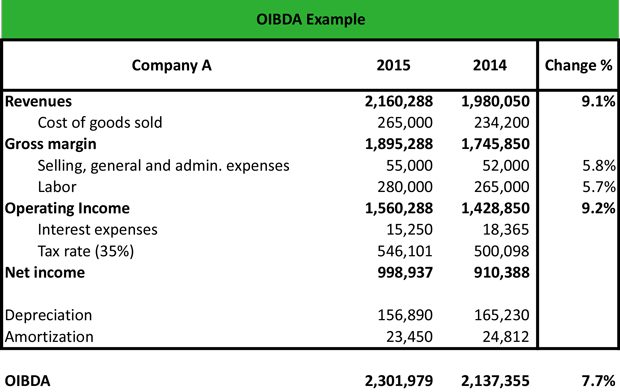

In the fiscal year 2015, company A generated an operating income of $1,560,288 from its regular operations. Depreciation amounted to $156,890 and amortization reached $23,450. Interest expenses were $15,250, whereas the company paid taxes equal to $543,101.

Marco is an accountant at company A, and he wants to calculate the company’s OIBDA for 2015 and compare it to the OIBDA of 2014:

OIBDA 2015 = OI + Depreciation + Amortization + Interest + Taxes = $1,560,288 + $156,890 + $23,450 + $546,101 + $15,250 = $2,301,979

OIBDA 2014 = OI + Depreciation + Amortization + Interest + Taxes = $1,428,850 + $165,230 + $24,812 + $18,365 + $500,098 = $2,137,355

OIBDA increased 7.7% YoY in 2015 following an increase in the operating income by 9.2% YoY as a result of an increase in revenues by 9.1% YoY. Although OIBDA is a proxy to EBITDA to analyze the cash flows a firm can generate from its core operations, it is widely used in the leveraged buyout (LBO) model as well as in the calculation of the total enterprise value (TEV) of a company.

Summary Definition

Define OIBDA: Operating income before depreciation & amortization is a financial measurement that calculates a company’s income without regard to paper expenses like depreciation and amortization.