Definition: Unearned revenue, also called deferred revenue, is the liability or amount of money owed for payment of goods or services by a customer before the goods or services have been delivered to that customer. In other words, if a customer pays for a good or service before the company delivers it, the company has to recognize that it owes the customer for that good or service.

What Does Unearned Revenue Mean?

What is the definition of unearned revenue? GAAP requires businesses to use the accrual basis of accounting. This means that all revenues are recorded when earned regardless of when the cash is actually received. In other words, a customer who buys a shirt on December 31 and pays for in on January 1 is considered to have bought the shirt on December 31. The retailer records a December sale. This concept also applies for customers who put down deposits on sales.

Since the good or service hasn’t been delivered or performed yet, the company hasn’t actually earned the revenue. It records a liability until the company delivers the purchased product.

Let’s take a look at an example

Example

A good example of deferred revenue is a magazine subscription. Usually you pay for a 12-month magazine subscription upfront, but you don’t actually receive all of the magazines right away. You receive one magazine a month until the end of the year. This is considered unearned income to the company until it delivers all 12 months of magazines. Instead of recording revenue when the magazine subscription is purchased, the company records unearned revenue in a liability account.

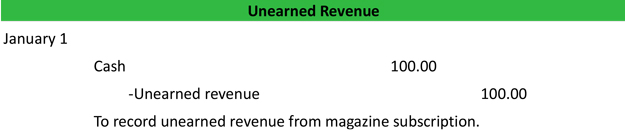

When the magazines are delivered and the subscription is fulfilled, the deferral account is zeroed out to the revenues account. Here is an example journal entry.

Summary Definition

Define Unearned Revenue: Unearned revenue is a customer payment that a business recognizes as a liability because it is received before the goods or services are delivered to the customer.