Definition: Unlevered free cash flow (UFCF) is the money available before the interest expenses to all sources of capital.

What Does Unlevered Free Cash Flow Mean?

What is the definition of unlevered free cash flow?Firms with the ability to generate strong free cash flows are those that distribute dividends to shareholders, implement share buybacks or lower their debt. The UFCF is the cash flow that a firm has available to paying the interest expenses, which tally with a given period, quarter or year. UFCF provides an indication of a firm’s financial strength, especially in the cases of mergers and acquisitions.

Let’s look at an example.

Example

Jacob works as an economist at the IMF. He deals with different projects daily; however, one of his most favorite tasks is to calculate the UFCF of different firms that operate in a variety of sectors and compared them to the sector average.

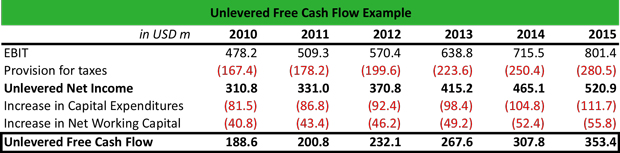

The firm he is currently analyzing in a pharmaceutical company, a leader in the field, which has recently merged with a competitive firm. Jacob collects the following information from the company’s income statement:

Some useful information:

Capex = maintenance expenditures that seek to extend the useful life of the company’s assets or expansion expenditures that the company makes when seeking expansion of its product line, entry in a new market or acquisition of a new business. When the capital expenditures increase, they are deducted from the net income. When the capital expenditures decrease, they are added to the net income.

Net working capital = current assets – current liabilities. When the difference is positive, the net working capital is deducted from the net income. When the difference is negative, the net working capital is added to the net income.

Summary Definition

Define Unlevered Free Cash Flows: UFCF means the cash from activities that is accessible for shareholders and creditors.