Definition: A warranty is a seller’s obligation to fix or replace a product that breaks or stop working properly in an agreed amount of time. In other words, a warranty is a contract or agreement between the seller and the buyer that requires the seller to replace defective products sold to the buyer.

What Does Warranty Mean?

Almost all retailers and manufacturers sell extended warranties. I’m sure you have been asked if you wanted to purchase one at some point in the recent past.

Accounting for warranties requires estimation and experience because not all products break. Retailers don’t have to fix or replace 100% of the products they sell warranties for. If they did, they might stop selling warranties because it would be too costly. When a retailer sells a product with a warranty to a customer, the retailer records the income from the sale and the cash received. It also records an estimate of the warranty expense.

Download this accounting example in excel.

Example

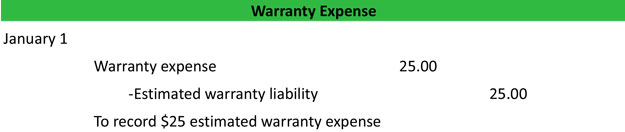

For instance, Best Buy sells a TV for $500 with a one-year warranty. Best Buy knows from experience that on average warranty expenses for this TV are about 5% of the sales price, so Best Buy would record the $25 estimated warranty expense for the year by creating a liability for the future warranty. This way Best Buy will show on its balance sheet that it owes customers $25 in possible warranty costs at the end of the year.

What is a Warranty Liability Recorded?

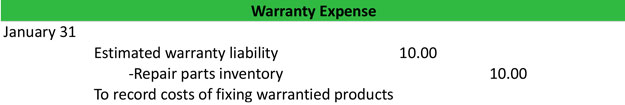

If the customer’s TV did break during the one-year warranty period, Best Buy would be required to fix it. Best Buy might record an entry like this to decrease the warranty liability and show the parts that were used to fix the TV.

Download this accounting example in excel.