An accrued expense journal entry is a year-end adjustment to record expenses that were incurred in the current year but weren’t actually paid until the next year.

The matching principle dictates that all revenue and expenses need to be matched according to the year they were earned and incurred. In other words, expenses usually benefit the business by providing resources to produce revenue. If an expense was incurred during the year, it must be matched to the revenue that was created from the expense during the year.

Even if the expense wasn’t actually paid during the year, the expense should be recorded with an accrued expense journal entry and matched with the corresponding income. Expenses that are incurred but not paid are called accrued expenses. Some of the most commonly accrued expenses are rent, utilities, and payroll.

Payroll is probably the most common accrued expense. Many times the end of the year falls in between pay periods. For example a pay period might start on December 24th and end on January 7th. So employees work one week in December, but they aren’t paid until the following year. The amount of payroll in December should be recorded in December with an accrued expense journal entry and accounted for on that year’s income statement.

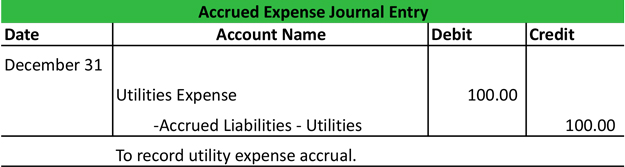

The accrued expense journal entry debits the expense account that is being accrued and credits the accrued liability account. A liability is recorded because the company still owes the expense. It hasn’t paid for it yet. The company only incurred the expense.

Accrued Expense Journal Entry Example

Jen’s Fashion Boutique is a retailer with three employees. Jen’s Fashion Boutique rents a small storefront in the local mall for $1,000 a month and usually incurs $200 a month in utility expenses. Jen’s electric bill is due on the 15th of every month. At the end of December, Jen has incurred 15 days worth of electrical expenses but won’t actually pay them until January 15th. These 15 days worth of utility expense must be accrued at the end of the year. Jen’s Fashion Boutique would accrue its utilities in this accrued expense journal entry.