Definition: The accounting rate of return (ARR), also called the simple or average rate of return, is an investment formula used to measure the annual earnings or profit an investment is expected to make. In other words, it calculates how much money or return you as an investor will make on your investment.

What Does Accounting Rate of Return Mean?

What is the definition of accounting rate of return? ARR is an important calculation because it helps investors analyze the risk involved in making an investment and decided whether the earnings are high enough to accept the risk level.

This Most people and companies have some types of investments. Whether the investments are short-term CDs or long-term retirement plans, investments play a big role in Americans’ lives. The only way to tell whether an investment is worthwhile or not is to measure the return or amount of money the investment has made and is expected to make in the future. To do this we must know how to calculate the accounting rate of return.

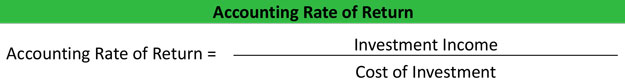

The accounting rate of return formula is calculated by dividing the income from your investment by the cost of the investment. Usually both of these numbers are either annual numbers or an average of annual numbers. You can also use monthly or even weekly numbers. The time length doesn’t matter.

Let’s take a look at an example.

Example

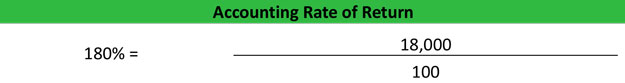

Let’s assume that you invested $100 into your racecar. After making the investment, you won $18,000 in prizes. Your ARR would be:

Obviously, this is a huge return and a racecar isn’t your typical investment. This great return might have had more to do with your driving abilities than the actual investment, but the principle is the same. I would still tell you to keep putting money into your racecar with returns like this.

Summary Definition

Define Accounting Rate of Return: ARR means the percentage income that an investment will make over a period of time calculated by dividing the investment income by the investment cost.