The goodwill to assets ratio is a financial measurement that compares the intangible assets like a brand name, customer list, or unique position in an industry to the total assets of the company in an effect to see if goodwill is being recorded properly.

Definition – What is the Goodwill to Assets Ratio?

Contents

Goodwill is synonymous with reputation and in business that can be a huge asset for a company. The accounting term goodwill gives a way for companies to value their reputation in a monetary form. Though it’s important and can carry significant value, goodwill needs to be compared to other assets when determining a company’s value.

This is where the goodwill to assets ratio comes into play. It’s a measurement that shows the relationship between a company’s definitive assets and the power of its namesake. The higher the ratio, the higher the value of the company’s goodwill vs actual assets.

U.S. GAAP and IFRS accounting rules have given management the sole responsibility for tracking and valuing goodwill. Therefore, investors, creditors, and the company’s own management should carefully review asset valuations and distinguish between non-monetary items like client relationships and brand reputation and tangible assets, such as property, machinery and equipment. Giving too much value to brand name or reputation may skew the true financial picture and hide potential problems.

Let’s take a look at how to calculate the goodwill to assets ratio.

Formula

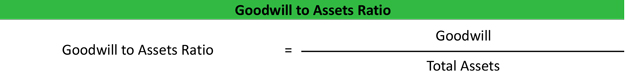

The goodwill to assets ratio formula is calculated by dividing total assets by the total goodwill found on the company’s balance sheet.

Goodwill to Assets Ratio = Goodwill / Total Assets

The first step in this calculation is finding the goodwill and total asset values in the financial statements. Total assets should be easy to locate on the balance sheet. Goodwill can be found in the non-current assets section of the balance sheet.

Sometimes, goodwill can be tricky to determine but is, essentially, the difference between all defined assets and the total asset valuation. Do not, however, confuse goodwill and intangible assets. Though both are intangible, goodwill is specifically reserved for items that are not typically found on the balance sheet like reputation and brand awareness.

Companies typically only have goodwill on their balance sheets if they purchase another company or asset for more than the book value or fair market value of the company or asset. For instance, if Company B was worth $10M and Company A bought it for $60M, $10M would be recorded as an asset purchase and $50M would be recorded as goodwill since this is the amount of money that Company A attributes to Company B’s non-balance sheet assets.

This ratio is reflected as a percentage of total assets. In other words, it shows us what percentage of assets goodwill represents.

Let’s take a look at an example.

Example

Apple, Inc. is world-renowned for its innovative products and fiercely loyal customers. It’s a brand that needs no introduction because it has incredible value just in its name. Let’s assume that there was a company big enough to acquire Apple. It would have to pay way more than the book value of Apple’s assets because of Apple’s reputation, customers, and industry status. This extra amount paid over the book value is considered goodwill.

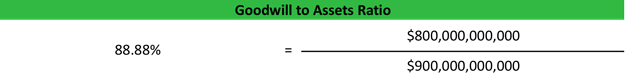

In this hypothetical transaction, assume Apple is asking $900 billion. The purchaser must determine if this is a fair price and needs to know how much is being paid for the name alone. The book value, according to Apple’s most recent balance sheet, amounted to $100 billion. Let’s assume in this case that there is no debt to be acquired. So, the amount of goodwill being acquired at this purchase price would be $800 billion. The purchaser uses the following formula:

Goodwill to Assets Ratio = $800,000,000,000 / $900,000,000,000 = 88.8%

The resulting ratio of 88.8% illustrates that Apple is attributing most of its total value to its goodwill. In other words, its brand image and reputation are worth eight times more than its tangible assets. This doesn’t seem logical but can be the case for certain brands. The potential purchaser will have to review other pieces of information to determine if the investment is worth the valuation Apple is currently requesting.

Analysis and Interpretation

The acquiring company in the scenario above should compare this goodwill to assets ratio with other companies in the industry to see if Apple’s is in line with others. If in the same industry, the purchaser may also consider the threat of Apple’s goodwill as a competitor brand in the valuation. For example, continuing competition with Apple may cost the company more than if it acquires the brand for its own benefit.

If the purchaser in this scenario went through with the acquisition, it would then begin reporting that $800 billion of goodwill obtained in the purchase on its own balance sheet. This will affect the purchasing company’s balance sheet and its own value.

Usage Explanation – Cautions, and Limitations

Shareholders and investment analysts pay attention to changes in the goodwill to assets ratio to see how mergers and acquisitions like this affect the company’s value. For example, a decreasing goodwill to assets ratio may mean brand image has been marred in some way but could also be caused by increasing values of other company assets. So, it’s not always a bad sign.

If this ratio continues to decrease as a result of damage to image, reputation or the like, the company will have to mark down its goodwill through goodwill impairment. This is made clear on financial statements, so it is easy to determine if that is the cause.

An increasing goodwill to assets ratio signifies goodwill acquired is outpacing other asset values. This could be a good thing to a common stock shareholder, signifying brand growth, but to a bondholder it could look scary, as the goodwill value is meaningless in the liquidation of a company. It could also mean that the company is acquiring more companies and over paying for them. Thus, acquiring little tangible assets and filling the balance sheet with “not real” assets.

A good example of this is Microsoft’s acquisition of Nokia. A year after the acquisition, Microsoft wrote off over $4B of goodwill simply because they realized they overpaid for it and it wasn’t worth that much money.

As with other financial analysis tools, this ratio presents some key information about the health of a company in a relative sense. Always dig deeper to find out what may be the underlying cause as to why a company has either a high or low GTA ratio and how that compares to the other companies in the industry.