The long-term debt to total asset ratio is a solvency or coverage ratio that calculates a company’s leverage by comparing total debt to assets. In other words, it measures the percentage of assets that a business would need to liquidate to pay off its long-term debt.

A company can have two types of liabilities on its balance sheet: Short-term (due within 1 year) and long-term (due in more than 1 year). Long-term debt ratio is a ratio which compares the amount of long-term debt to the value of total assets on the books of a company. In other words, it gives a sense of financial leverage of a company.

Definition: What is the Long Term Debt Ratio?

Contents

A company can build assets by raising debt or equity capital. The ratio of long-term debt to total assets provides a sense of what percentage of the total assets is financed via long-term debt. A higher percentage ratio means that the company is more leveraged and owns less of the assets on balance sheet. In other words, it would need to sell more assets to eliminate its debt in the event of a bankruptcy. The company would also have to generate strong revenue and cash flow for a long period in the future to be able to repay the debt.

This ratio provides a sense of financial stability and overall riskiness of a company. Investors are wary of a high ratio, as it signifies management has less free cash flow and less ability to finance new operations. Management typically uses this financial metric to determine the amount of debt the company can sustain and manage the overall capital structure of the firm.

Let’s look at how to calculate the long-term debt ratio.

Formula

Long-term debt to assets ratio formula is calculated by dividing long term debt by total assets.

Long Term debt to Total Assets Ratio = Long Term Debt / Total Assets

As you can see, this is a pretty simple formula. Both long-term debt and total assets are reported on the balance sheet.

Total Assets refers all resources reported on the assets section of the balance sheet: both tangible and intangible.

Long-term debt refers to the liabilities which are due more than 1 year from the current time period

One thing to note is that companies commonly split up the current portion of long-term debt and the portion of debt that is due in 12 or more months. For this long-term debt ratio equation, we use the total long-term debt of the company. This means that we add the current and long-term portions of long-term debt.

Now that you understand how to calculate the LT Debt to Assets equation, let’s look at some examples.

Examples

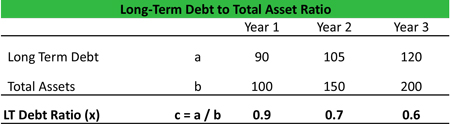

Let’s look at an example of Tim’s Tool Co. Tim’s financial data from his balance sheet is shown below and the ratio is calculated for the past three years. As you can see, Tim’s assets are increasing faster than his total debt. Thus, the ratio has decreased in the last three years.

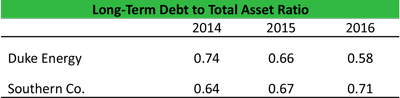

Now, let’s take a look at an example of two different US based utility companies: Southern Co. and Duke Energy. We calculated the Long-term debt ratio using the SEC 10K. Here are the results:

As we can see from the numbers, the LT debt ratio has been generally over 0.6x for both the companies during 2014-16 period. This could imply that the company has been funding its assets and expansion largely from debt (more on this in the interpretation section below).

Let’s analyze and interpret the ratio and see what key information about the financial health of the companies we can extract.

Analysis and Interpretation

Typically, a LT debt ratio of less than 0.5 is considered good or healthy. It’s important to analyze all ratios in the context of the company’s industry averages and its past. For capital intensive industry the ratio might be higher while for IT software companies which are sitting on huge cash piles, this ratio might be zero (i.e. no Long-term debt on the books).

In the Tim’s Tile Co. example above, I mentioned that the ratio was decreasing even when the debt was increasing. This could imply that Tim’s Tile Co. is creating value accretive assets (thus assets are surpassing the debt increase) or using other means of funding growth.

In the Duke and Southern Utility example, we can see that Duke reduced its LT debt ratio while Southern increased its. Looking at the numbers closer, we see that Southern has been adding debt to its books (organically or by acquiring companies) to grow its operations. If this strategy works, it could create long-term value for investors. Normally, lower the ratio better it is. But that is not the absolute truth.

LT debt ratio provides a theoretical data point and can act as a discussion starter. Analyst need to understand the underlying causes of the ratio changes. For risk adverse investors a low LT debt ratio is preferable while investors with high-risk appetite may tolerate higher financial leverage. The choice of the level of ratio will also depend on the industry and the industry cycle. For example, in the oil & gas industry during the recent oil price decline (2014-16) many smaller companies with high level of debt were more severely penalized than the stable large integrated Oil & Gas companies. In bear market (or risk-off environment) investors prefer companies with lower debt levels while in bull-market (or risk-on environment) geared companies are favored as they can provide higher earnings growth. Analysts need to be cognizant of all these factors while analyzing a company.

Analyst should also understand the ideal capital structure that management is seeking. Suppose the management has guided towards a LT debt ratio of 0.5x in next 5 years as part of achieving its optimal capital structure, than analyst should track the movement of the ratio in the next five years to gauge the execution capability of the management. Analyst could also forecast the financial statements 5 years out, to predict if the desired capital structure (as measured by LT debt ratio) is achievable or not.

For instance, management might strive for an aggressive target simply to spur investor interest. Analysts must be aware of what the company is doing without being tricked with short-term strategies. That’s why it’s so important to review the management discussion section of a 10-K of the quarterly earnings reports.

Lenders, on the other hand, typically set covenants in place to prevent companies from borrowing too much and being over leveraged. LT term debt ratio is one such commonly used covenant in which the lender will restrict the ratio to rise above certain value. The loan terms also explain how flexible the company can be with the covenants. These rules force management to be disciplined because if the debt covenants are broken, the company will have to repay the loans immediately. This could cause a negative financial or reputational impact such as fines, foreclosures or credit downgrades.

Practical Usage Explanation: Cautions and Limitations

As with any balance sheet ratio, you need to be cautious about using long debt to value a company, specifically for the total assets in the calculation. The balance sheet presents the total asset value based on their book values. This can be significantly different compared with their replacement value or the liquidation value.

The ratio doesn’t consider several debt obligations such as ‘short-term debt’. A company might be at immediate risk of a large debt falling due in next 1 year, which is not captured in the long-term debt ratio.

It’s also important to look at off-balance sheet items like operating lease and pension obligations. These items are not presented in the long-term liabilities section of the balance sheet, but they are liabilities nonetheless. If you don’t include these in your calculation, your estimates will not be completely correct.

Keep in mind that this ratio should be used with several other leverage ratios in order to get a proper understanding of the financial riskiness of a company. Some of other relevant ratios that you can use are the Total debt to total assets ratio, Total debt to Equity ratio, and the LT debt to Equity ratio.

That’s how you can use the LT-debt ratio to measure a company’s financial leverage and calculate its overall risk. Used properly while considering all the loopholes, this metric can be an important tool to initiate constructive discussion with the management about the future of the company.