Definition: A debit is an accounting term for an entry made on the left side of an account. Many times debit is abbreviated as Dr.The double entry accounting system is based on the concept that total debits always equal total credits.

What Does Debit Mean in Accounting?

A debit does not mean an increase or decrease in an account. Many accounting students make this mistake. A debit is always an entry on the left side of an account. Depending on the account, a debit can increase or decrease the account. Accounts that have debit or left balances include assets, expenses, and some equity accounts. This means that a debit recorded in an asset account would increase the asset account.

Conversely, liabilities and revenue accounts have credit or right balances. A debit recorded in a revenue account would decrease the revenue account.

Example

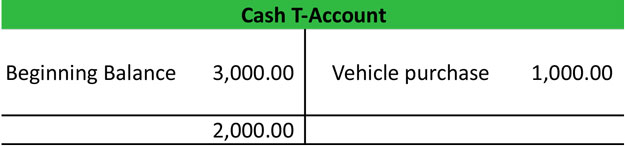

Take this T-account of the cash account for example. Cash is an asset; so all debits would increase the asset account. The credits in the T-account decrease the balance in the cash account. This cash account has a debit for $3,000 and a credit for $1,000. This gives the cash account a debit balance of $2,000. In other words, this company has $2,000 in its checking account right now.

If the company had a credit of $4,000 instead of the credit for $1,000, the company would have a credit balance in its cash account of $1,000. This means the company over drafted its checking account by $1,000.