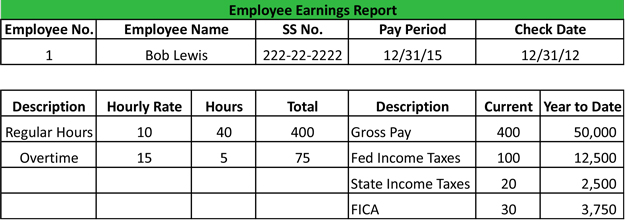

Definition: An employee earnings report is a record that details an employee’s payroll history. Employee earnings reports, or pay stubs, are usually attached to employee paychecks. These reports often have columns totaling how many employee hours were worked, their net pay, gross pay, deductions from payroll, and other year-to-date payroll information.

What Does Employee Earnings Report Mean?

Many times employers also report payroll taxes on employee earnings reports like FICA, FUTA, SUTA taxes.

Employers prepare earnings reports for their employees, so employees can keep records of this important financial information. Since many employees are enrolled in employee benefit programs like health insurance and retirement plans, employees have the right to know how much money is being taken out of their paychecks to fund their portion of these plans.

Probably the most important item listed on an employee earnings report is the amount of federal and state income taxes withheld from the employee’s wages. Employees can track their withholdings through the year and make decisions about increasing or decreasing their withholding rates based on their employee earnings report.

Example

The information that is reported on an employee earnings report is taken directly from the employer’s payroll register. Here is an example of a typical employee earnings report. As you can see, the employee’s name, employee number, social security number, pay period, check date, regular hours worked, and overtime hours worked are reported.

Download this accounting example in excel.

Additional items may be reported depending on the employee’s involvement in company programs and employee benefit packages.