Definition: Job costing is an expense monitoring system that assigns manufacturing costs to each product, enabling managers to keep track of expenses.

What Does Job Costing Mean?

What is the definition of job costing? Job costing systems determine manufacturing costs systematically by dividing them in overhead, direct material, and direct labor costs and estimating them at their actual value. Manufacturing firms are using job costing to control the use of raw materials, labor hours and equipment by allocating the cost of each customer order separately.

Especially, when a firm’s products are not identical, job costing in an effective tool to allocate the cost of each product and keep track of the order expenses. Nowadays, most businesses are using computerized job costing systems to improve cost control and boost their profitability.

Let’s look at an example.

Example

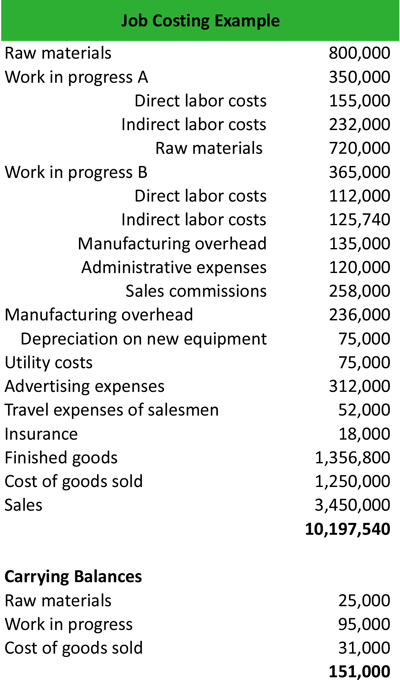

Manufacturing company ABC uses a job costing system to allocate job order costs at their actual value and track costs accurately to generate a profit. In January 2015, the company’s project manager prepared a yearly plan, estimating approximately $625,000 in overhead costs. Moreover, the carrying balances from 2014 were raw materials $25,000, work in progress $95,000, and finished goods $31,000.

During 2015, the company has recorded a variety of transactions, as follows:

The company’s accountant prepares the job costing sheet taking into account the transactions of the year and the carrying balances, as follows:

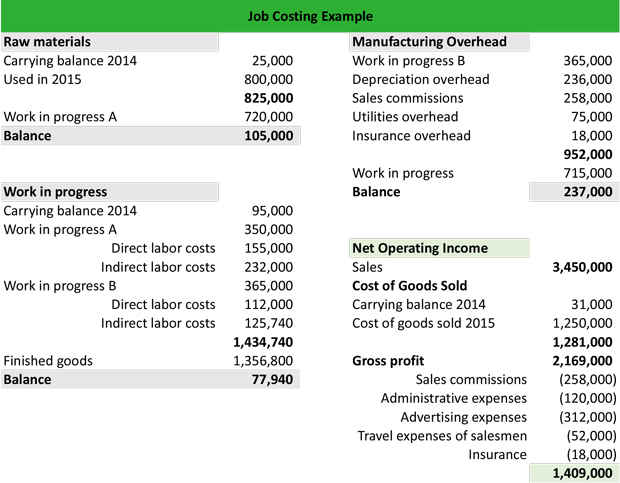

He allocates the costs per type of cost by creating three main categories, Raw Materials, Work in Progress and Manufacturing Overhead.

Raw Materials includes the carrying balance of $25,000 for 2014 and $800,000 for 2015. From the total of $825,000, the accountant deducts the cost of raw material used in work in progress A $720,000. The remaining balance is $105,000.

Work in Progress includes the carrying balance of $95,000 for 2014, and the direct and indirect costs for work in progress A and work in progress B. From the total of $1,434,740, the accountant deducts the cost of finished goods. The remaining balance is $77,940.

Manufacturing Overhead includes the costs of work in progress B, the overhead for depreciation, utilities and insurance, and the sales commissions expenses. From the total of $ 952,000, accountant deducts the cost of work in progress A and work in progress B. The remaining balance is $237,000.

Now, he can calculate the net operating income for 2015 by deducting the cost of goods sold for the company’s sales to find the gross profit. Then, he deducts the costs of sales commissions, administrative expenses, advertising expenses, travel expenses, and insurance to arrive at a net operating income of $1,409,000.

Summary Definition

Define Job Costing: Job costing means a method of allocating manufacturing costs to objects or centers.