Definition: A large stock dividend is a stock dividend that distributes more than 25% of the outstanding shares of the company.

What Does Large Stock Dividend Mean?

Many companies issue dividends to shareholders to maintain stock prices and stock demand. Companies like GE issue dividends to its shareholders every year. These quarterly and annual payments drive the demand for GE stock.

Obviously, in order for a company to issue a dividend, it has to have the cash to give to its shareholders. What happens when a company wants to incentivize its shareholders with a dividend, but it doesn’t have the cash to issue a dividend?

Companies can issue a stock dividend. Instead, of giving shareholders cash, the company gives them additional, unissued stock. A stock dividend is also different from a cash dividend in that a cash dividend reduces assets and equity. Cash is given away while the dividend reduces the companies retained earnings.

A stock dividend merely transfers equity from the company to the shareholder. Retained earnings decreases while contributed capital increases. As you can see, this is a great option for companies with little cash in the bank.

Example

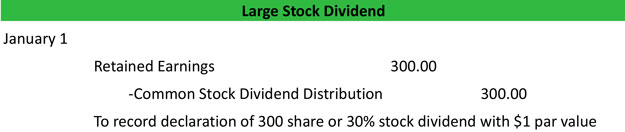

So if Green Guitar, Inc. had 1,000 shares of $1 outstanding stock and issued a 300 share stock dividend, it would be considered a large stock dividend. Most states require that corporations capitalize in retained earnings a portion, usually the par value, of a large stock dividend. Here’s Green Guitar, Inc.’s large stock dividend is recorded and capitalized.

Download this accounting example in excel.