Definition: A non-controlling interest, also called NCI or minority interest, is an ownership position where a corporate shareholder owns less than 50 percent of outstanding shares and can only influence management decisions instead of controlling them.

What Does Non-controlling Interest Mean?

What is the definition of non-controlling interest? Applying this concept to corporate owners, a non controlling interest is the ownership interest in a subsidiary company, which is owned by outside investors and not the parent company. Generally, a minority interest in a subsidiary company is less than 50% of the total number of shares outstanding.

The parent company reports the financial results of the subsidiary company in its consolidated balance sheet to present a claim on assets by minority shareholders or in its consolidated income statement as a percentage of profits belonging to minority shareholders. Minority interest shareholders have less influence on a firm’s management and policies, and restricted voting rights, but they offer significant growth for the firm with their experience and capital.

Let’s look at an example.

Example

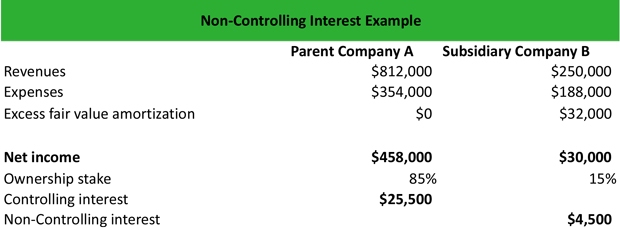

Company A acquires 85% of the 50,000 shares outstanding of company B, leaving a non controlling interest of 15%. At the end of the fiscal year, Company A (parent) reports revenues of $812,000 and expenses of $354,000, whereas Company B (subsidiary) reports revenues of $250,000 and expenses of $188,000. Furthermore, the excess fair value amortization of Company B following its acquisition is $32,000.

Adam, a financial analyst at the securities firm who has acted as an advisor to the acquisition, wants to calculate the controlling interest of Company A on the net income of Company B, the non-controlling interest of Company B, the consolidated net income, and the net income of the Company A.

Adam calculates the net income of Company B (subsidiary) as follows:

Revenues – expenses – excess fair value amortization = $250,000 – $188,000 – $32,000 = $30,000. Based on the acquisition percentages, the controlling interest of Company A on Company B is $30,000 x 85% = $25,500 and the non-controlling interest is $30,000 x 15% = $4,500.

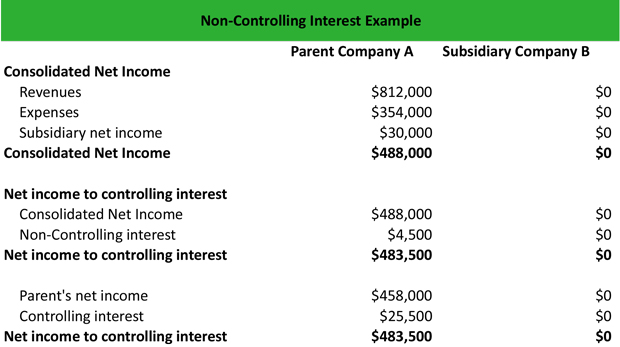

Adam calculates the consolidated net income as follows:

Revenues – expenses + subsidiary net income = $812,000 – $354,000 + $30,000 = $488,000.

Therefore, the net income to controlling interest is Consolidated income – non-controlling interest = $488,000 – $4,500 = $ $483,500, and Parent’s net income – controlling interest = $ 458,000 + $25,500 = $483,500.

There are several different rules for consolidating subsidiaries based on ownership percentage and influence. Remember that ownership a influence are not always hand in hand. A minority shareholder might still have considerable influence in corporate decisions even though he doesn’t own a majority of the stock. Take Bill Gates for instance. Before his retirement from Microsoft, he owned 8 percent of the company but had significant influence over the decision-making.

Summary Definition

Define Non Controlling Interest: Noncontrolling interest represents an ownership stake in the equity of a subsidiary company, which is not controlled by the parent company.