A sales journal entry is a journal entry in the sales journal to record a credit sale of inventory. All of the cash sales of inventory are recorded in the cash receipts journal and all non-inventory sales are recorded in the general journal.

Since a sales journal entry consists of selling inventory on credit, four main accounts are affected by the business transaction: the accounts receivable and revenue accounts as well as the inventory and cost of goods sold accounts.

When a piece of merchandise or inventory is sold on credit, two business transactions need to be record. First, the accounts receivable account must increase by the amount of the sale and the revenue account must increase by the same amount. This entry records the amount of money the customer owes the company as well as the revenue from the sale.

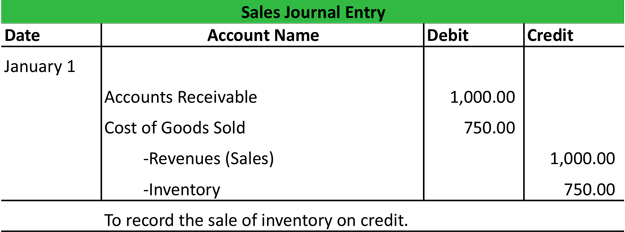

Second, the inventory has to be removed from the inventory account and the cost of the inventory needs to be recorded. So a typical sales journal entry debits the accounts receivable account for the sale price and credits revenue account for the sales price. Cost of goods sold is debited for the price the company paid for the inventory and the inventory account is credited for the same price.

Sales Journal Entry Example

Little Electrodes, Inc. is a retailer that sells electronics and computer parts. On January 1, Little Electrode, Inc. sells a computer monitor to a customer for $1,000. Little Electrode, Inc. purchased this monitor from the manufacturer for $750 three months ago. Here’s how Little Electrode, Inc. would record this sales journal entry.