Definition: The accrual accounting rate of return takes the accounting rate of return calculation and applies the accrual method of accounting. This means that the income from the investment is recognized on the accrual basis. In other words, the income is recognized when it is earned not when it is received.

Definition: The accrual accounting rate of return takes the accounting rate of return calculation and applies the accrual method of accounting. This means that the income from the investment is recognized on the accrual basis. In other words, the income is recognized when it is earned not when it is received.

What Does Accrual Accounting Rate of Return Mean?

Contents

- What Does Accrual Accounting Rate of Return Mean?

- Example

- Why is AARR Important?

- Calculating the Accrual Accounting Rate of Return

- Example: Applying AARR in Practice

- Advantages of Using AARR

- Limitations of AARR

- AARR vs. Cash-Based Metrics

- Integrating AARR with Other Metrics

- Frequently Asked Questions

- Bottom Line

The accrual accounting rate of return (AARR) is a financial metric that evaluates the profitability of an investment or project by accounting for revenues and expenses on an accrual basis. Unlike cash-based methods, AARR recognizes income when it is earned and expenses when they are incurred, offering a more accurate depiction of an investment’s financial impact.

Most people and companies have some types of investments. Whether the investments are short-term CDs or long-term retirement plans, investments play a big role in Americans’ lives. The only way to tell whether an investment is worthwhile or not is to measure the return or amount of money the investment has made. In accounting, we call this measurement the accounting rate of return.

Example

For example, if you own a bond that pays interest on the last day of the month and day of March is on a Sunday, the interest might be paid in the month of March. It will probably get paid on the first of April. The accrual basis of accounting would recognize that income in the month of March because it was earned in March even though it wasn’t actually received until April.

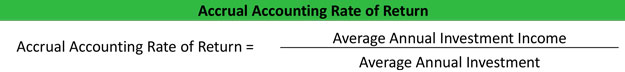

Just like the accounting rate of return, the accrual accounting rate of return usually uses annual or annual average income and investment numbers. Monthly and weekly number can also be used for specific purposes.

Here is how the accrual accounting rate of return is calculated:

Why is AARR Important?

The AARR provides investors and businesses with a reliable way to measure the return on an investment while adhering to the principles of accrual accounting. By focusing on when income is earned and expenses are incurred, AARR aligns with the matching principle, ensuring that financial evaluations are both accurate and consistent.

For example, consider a company evaluating the purchase of a new machine that generates revenue over five years. Using AARR, the company can assess the profitability of the machine by considering revenues and expenses in the periods they are earned or incurred, rather than when cash transactions occur. This helps the company make a more informed decision about whether the investment is worthwhile.

Calculating the Accrual Accounting Rate of Return

The AARR formula is straightforward:

AARR=Average Annual Accrual Accounting Income / Average Investment

- Average Annual Accrual Accounting Income: This includes all revenues earned minus expenses incurred during the investment’s life, averaged over the investment period.

- Average Investment: This is typically the initial investment plus the residual value (if any) divided by two, though it can vary depending on the specific calculation method.

For instance, if a business invests $200,000 in a new project that generates an average annual income of $40,000, the AARR would be:

AARR= (40,000 / 200,000) × 100 = 20%

This means the project generates a 20% return annually based on the accrual basis.

Example: Applying AARR in Practice

Imagine a real estate company investing $1,000,000 in a new commercial building. The building generates $150,000 in annual rental income, while annual expenses, including maintenance and property taxes, total $50,000.

Using the AARR formula:

Average Annual Income: 150,000 (revenue) − 50,000 (expenses) = 100,000

Average Investment: Assuming a residual value of $200,000: (1,000,000 + 200,000) / 2 = 600,000

AARR: 100,000 / 600,000 × 100 = 16.67%

The AARR of 16.67% helps the company determine if the return meets its required rate for profitability.

Advantages of Using AARR

- Simplicity: AARR is straightforward to calculate and understand, making it accessible for decision-makers.

- Accrual-Based Accuracy: By incorporating revenues and expenses when they are earned or incurred, AARR provides a realistic picture of financial performance.

- Comparability: AARR allows businesses to compare different investments or projects using a consistent methodology.

For instance, a company evaluating two potential investments with AARRs of 15% and 20% can prioritize the higher-return option, assuming similar risk levels.

Limitations of AARR

Despite its usefulness, AARR has limitations:

- Exclusion of Cash Flows: AARR focuses on accounting income rather than actual cash flows, which may not reflect liquidity or cash management needs.

- Time Value of Money: AARR does not account for the time value of money, unlike methods such as net present value (NPV) or internal rate of return (IRR).

- Uniform Income Assumption: AARR assumes consistent annual income, which may not be realistic for projects with fluctuating revenues or expenses.

For example, a technology startup with uneven income growth due to market cycles may find AARR less reliable for evaluating its projects.

AARR vs. Cash-Based Metrics

AARR differs significantly from cash-based metrics, which consider only cash inflows and outflows.

AARR recognizes income and expenses when they are earned or incurred, aligning with accrual accounting principles.

Cash-Based metrics reflect actual cash flow, providing a clearer picture of liquidity and short-term solvency.

For instance, a construction company using AARR might recognize revenue from a project upon completion, while a cash-based method would record it only when payment is received.

Integrating AARR with Other Metrics

While AARR is valuable for measuring profitability, it is most effective when combined with other metrics:

Net Present Value (NPV)

Accounts for the time value of money, complementing AARR’s accrual-based approach.

Payback Period

Measures the time required to recover the initial investment, offering insights into liquidity.

Internal Rate of Return (IRR)

Provides a percentage-based return that incorporates cash flows and the time value of money.

For example, a retail chain evaluating store expansions might use AARR for an initial profitability assessment and NPV for a deeper financial analysis.

Frequently Asked Questions

What is the accrual accounting rate of return?

The accrual accounting rate of return (AARR) measures the profitability of an investment by considering accrual-based revenues and expenses. It calculates the return as a percentage of the average investment.

How is the AARR calculated?

AARR is calculated using the formula: \( \text{AARR} = \frac{\text{Average Annual Accrual Accounting Income}}{\text{Average Investment}} \times 100 \). This measures the annual return generated relative to the average investment over a period.

What is the difference between AARR and cash-based return metrics?

AARR focuses on accrual-based accounting, recognizing revenues and expenses when they are earned or incurred. Cash-based metrics, like cash return, measure returns based solely on actual cash inflows and outflows.

Why is the AARR useful for investment decisions?

The AARR helps evaluate the profitability of investments while aligning with accrual accounting principles, ensuring accurate financial representation. It is particularly useful for comparing multiple projects or investments using consistent criteria.

Bottom Line

The accrual accounting rate of return is a versatile metric that provides valuable insights into the profitability of investments and projects. By aligning with accrual accounting principles, it ensures that revenues and expenses are recognized in the correct periods, offering a clear and accurate measure of financial performance.

While AARR has its limitations, integrating it with other financial metrics enables businesses to make informed decisions that balance profitability, cash flow, and risk. Whether used for evaluating new ventures or assessing ongoing projects, AARR remains an essential tool for effective financial management and long-term success.