Definition: An aging schedule is a summarized presentation of accounts receivable into separate time brackets that rank the receivables based upon the days until due or the days past due. In other words, it’s a list of receivables along with their customer, amount, and age.

What Does Aging Schedule Mean?

What is the definition of aging schedule? Generally, the longer the account balance is overdue, the more likely it will be uncollectable and will lead to a doubtful debt. Therefore, many firms create an aging schedule of accounts receivables to follow the pattern of collecting their account receivables and track the percentage of doubtful debts.

This schedule ranks each customer based on their total balance and outstanding balance and calculates an estimated percentage of uncollected accounts receivable as well as the total of bad debts. By keeping an aging schedule, firms can easily find out which customers are paying their bills in due time and which customers are less reliable, thus adjusting their credit policies. In the long-term, they can calculate the impact of past due accounts receivables on the firm’s cash flows.

Let’s look at an example.

Example

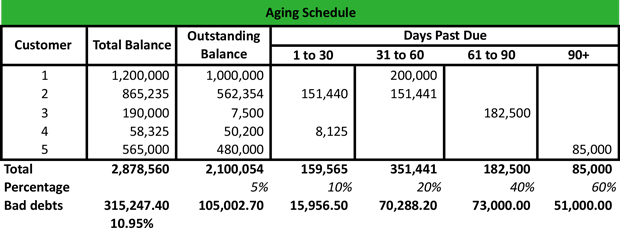

George is an accountant at a company that specializes in the sale of sports items. George wants to set up an schedule to analyze the pattern of collection for the firm’s account receivables and calculate the percentage of bad debts. The aging schedule that George creates is as follows:

The percentage of bad debts is calculated based on the percentages that George allocates to the balances. By allocating 5% on the outstanding balance, 10% in 1 to 30 days past due, 20% in 31 to 60 days past due, 40% in 61 to 90 days past due, and 60% in 90+ days past due, George finds out that the percentage of total debts is almost 11%.

If the firm changes the weights of each category of days past due, the percentage of total debts will increase or decrease, respectively. Therefore, by keeping an aging schedule of accounts receivables, a form can estimate the percentage of doubtful accounts and take the proper measures.

Summary Definition

Define Aging Schedule: An aging schedule is a chart that lists all of the outstanding receivables on account with customers by their due dates and percentage likely to be collected.