Definition: Basic Earnings Per Share (EPS) is a financial ratio that measures net income earned by or available to each common stockholder. The basic earnings per share ratio is often called earnings per share, EPS, and net income per share.

The Basic EPS is a widely employed metric in the investment field. For companies whose stocks are publicly traded, the Basic EPS is used to analyze the company’s ability to generate profits for its shareholders.

Indeed, investors and analysts largely rely on the Basic EPS to assess the performance of the company over time. This measure is reported in the company’s Income Statement, usually along with the Diluted EPS which is a calculation of the Earnings per Share that considers the effect of stock options and warrants.

Basic EPS is generally shown on a quarterly and annual basis, so investors can track the fluctuation in the company’s performance over time.

Contents

Basic Earnings per Share or Basic EPS is a profitability metric that shows how much of a firm’s net income was allotted to each share of common stock.

Simply put, Basic EPS is the company’s net after-tax profits divided by the number of shares outstanding.

Key Takeaways

Profitability Indicator: Basic EPS is a key metric that measures a company’s profitability allocated to each outstanding share of common stock, offering a direct insight into the company’s financial health and efficiency in generating profits.

Calculation Simplicity: It is calculated by dividing the net income (minus dividends on preferred stock, if any) by the total number of outstanding common shares, making it a straightforward financial metric for investors to assess a company’s earnings performance.

Investor Appeal: Basic EPS is crucial for investors as it helps them understand how much profit the company earned for each share they own, serving as a foundational tool for evaluating stock price value and company performance comparison across industries.

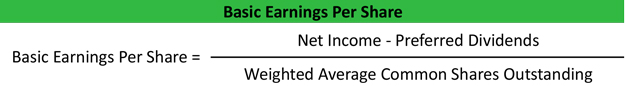

Basic EPS Formula

Basic earnings per share is calculated by subtracting the preferred dividends from net income and dividing that by the average number of common stock shares outstanding during the year.

Download this accounting example in excel.

The method to calculate Basic EPS is very simple if the analyst knows the net income or net earnings of the period and the number of outstanding shares at the end of such period.

The net income is the total earnings obtained by the company. It is the financial result once all costs, expenses, and taxes are deducted from the business net revenues. To obtain the total earnings it is also necessary to subtract the preferred dividends from the net income because as this amount does not go to common stockholders.

On the other hand, the number of shares tends to change throughout the time period. That is why the analyst has to calculate the weighted average of common shares outstanding during the period.

The calculation may be made as follows:

Basic EPS = (NI – PD) / CS

Where the components of the formula are:

NI = Net Income

PD = Preferred dividends

CS = Weighted average of common shares outstanding during the period.

Preferred dividends have to be taken out of net income because this money is not available to common stock holders. Preferred shareholders often have rights to dividends before common stockholders, so this money must be set-aside for preferred shareholders.

Preferred stock can be issued as noncumulative and cumulative preferred stock. If noncumulative preferred shares are issued, only the preferred dividends that are actually declared must be subtracted from net income.

Cumulative preferred shares are more inclusive. If cumulative preferred shares are issued, all preferred dividends whether declared or not must be subtracted from net income to establish the earnings available to common shareholders.

The weighted average method is used to compute the number of common stock shares outstanding during the year. The weighted average method for counting common stock outstanding is the same often used from counting and valuing inventory.

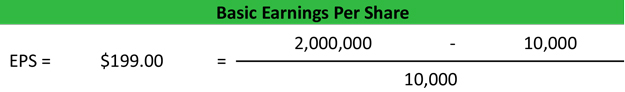

Example #1

For instance, assume Big Bad Band, Inc. has net income for the year of $$2,000,000, declares a $10,000 dividend on its noncumulative preferred stock, and has 10,000 common shares outstanding. The basic earnings per share of Big Bad Band, Inc. would look like this.

Download this accounting example in excel.

Example #2

Ultimate Company is a technology firm that has been operating for 5 years. Their 2015 report showed that the business produced a net income of $110 million after all costs, expenses, interest charges and taxes were deducted from net revenues.

There were also $2 million paid as dividends for preferred stockholders. That year the company had 200 million common shares outstanding and did not issue any additional shares so the weighted average of common shares outstanding during the period was 200 million. With that information, investors applied the Basic EPS formula as follows.

Net income = $110 million

Preferred dividends = $2 million

Common shares = 200 million

Basic EPS = (110 – 2) / 200 = $0.54

That figure means that for investors earned $0.54 in profits for each share they held. If an investor had 100 shares, his profit would be $54, which is 0.54 multiplied by 100.

At the end of 2016, the company issued its new Annual Report. The net income totaled $90 million and there were again $2 million paid as dividends to preferred stockholders.

That year the company did not issue additional shares but repurchased 40 million shares during the second half of the year. The investors wanted to know their Basic EPS and applied the formula again.

The weighted average of common shares outstanding during the period had to consider the repurchase made during that year. At the beginning of the period, the number of common shares was 200 million but at the end it was 160 million. The weighted average should be calculated as:

CS = (200 + 160) / 2 = 180

The weighted average of common shares outstanding during the 2016 period was 180 million. And with that information, the Basic EPS would be:

Net income = $90 million

Preferred dividends = $2 million

Common shares = 180 million

Basic EPS = (90 – 2) / 180 = $0.55

In 2016, investors got $0.55 in profits for each share they held. If an investor had 100 shares, his profit would be $55, which is 0.55 multiplied by 100.

How to Interpret Basic EPS Analysis

All investors would like to see positive and increasing Basic EPS. For this metric, the higher the figure the higher the profitability for shareholders is, at least in the short term.

A positive EPS not only means potential income for common shareholders but also a good opportunity to reinvest the earnings to continue growing the business. A negative EPS means loses and therefore no money for reinvestment neither for common shareholders.

When Basic EPS is increasing over time the investor may conclude that the company is improving its ability to turn its investments into profits. In contrast, a Basic EPS that show a decreasing trend during several periods should be carefully analyzed, because that could be a signal of structural problems that are affecting the company’s ability to earn money.

In the example described above, the common stockholders obtained a higher profit for each share they held in 2016 when compared to the 2015 period. In the short term, they should be happy with the results.

Basic EPS is a useful metric but it should not be analyzed in isolation as the sole indication of a company’s profitability or performance. It is necessary to understand how the different components of the formula added to the final result.

Moreover, an investor cannot know how efficient or appropriate the operations and financial decisions were during the analyzed period and if thy will benefit the company over the medium and long term by just looking at the Basic EPS.

Like other metrics, the Basic EPS is better analyzed when shown as a trend. If the analyst jumps to a conclusion based on a single year EPS he will be ignoring potentially important trends that may indicate if that year’s Basic EPS is actually sustainable or not.

For companies with complex capital structures, it is more convenient to analyze both EPS types, basic and diluted. The diluted EPS is calculated under the assumption that all convertible securities will be exercised.

Going back to the example, Ultimate Company increased its Basic EPS from 2015 to 2016 mainly due to the repurchase of common shares. Investors should analyze in detail the causes that diminished the net income from $110 to $90 million.

The management team could be making some decisions to increase the Basic EPS in the short term to make it look as if the company is earning more money, but that doesn’t necessarily benefit the long-term goals of the business.

Excessive leverage could be an example of that, as companies that use large amounts of debt to grow will earn more money than those that rely heavily on common stock, as the number of shares remain unaltered while profits are expanded, at the expense of the financial health of the business.

Frequently Asked Questions

How is Basic EPS calculated and what does it represent?

Basic EPS is calculated by dividing a company’s net income, minus any preferred dividends, by the total number of outstanding common shares. It represents the amount of profit attributed to each share of common stock, indicating the company’s profitability on a per-share basis.

Why is Basic EPS important for investors?

Basic EPS provides investors with a measure of the company’s profitability allocated to each share of common stock, helping them assess the value and performance of their investment relative to the company’s earnings.

Can Basic EPS fluctuate even if a company’s profit remains the same?

Yes, Basic EPS can fluctuate if the number of outstanding shares changes, due to actions like stock splits or buybacks, even if the company’s net income remains constant.

How does Basic EPS differ from Diluted EPS in financial analysis?

While Basic EPS calculates earnings based solely on current outstanding shares, Diluted EPS considers the potential impact of all convertible securities, offering a more conservative view of the company’s earnings per share by anticipating possible dilution.