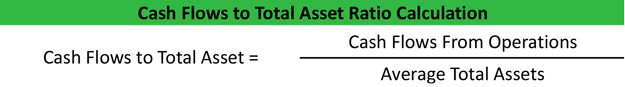

Definition: Cash flow on total assets is an efficiency ratio that rates actually cash flows to the company assets without being affected by income recognition or income measurements. The cash flow on total assets ratio is calculated by dividing cash flows from operations by the average total assets.

Example

The cash flow to total asset ratio is most often used by company management to estimate when cash will be available and how much cash will be available for future operations. Management can use this ratio to prepare budgets and future performance predictions. In other words, management can use this ratio to help estimate the availability of cash in future periods based on projected operations.

What Does Cash Flow on Total Assets Ratio Mean?

Investors also use the cash flows to total asset ratio to estimate the quality of a company’s earnings. The cash flow to assets ratio is much like the return on total assets ratio, which measures how efficiently a business uses its assets to create a return or income. The cash flows to total assets ratio shows investors how efficiently the business is at using its assets to collect cash from sales and customers. The higher the ratio, the more efficient the business is.

Remember that the cash flows to total assets ratio has nothing to do with income or profitability. It only has to do with the efficiency of cash flows. A business with an extremely high cash flows to total assets ratio might still report a loss on the income statement for the year.