Definition: Collateral is an asset that a borrower provides to a lender in event that he defaults on a loan or other line of credit.

What Does Collateral Mean?

What is the definition of collateral? Collateral is as a loan insurance in case the borrower fails to repay the loan or goes bankrupt. In this case, the lender has the legal right to seize the asset and either keep it or sell it to limit the losses. The most common form of collateral is the home mortgage. If the borrower stops paying the required installments to the bank, the bank has the right to confiscate the house (foreclosure) and try to sell it in the open market to regain some of the funds.

Due to the fact that collateral provides security to the lender in the event of default, mortgage loans usually have lower interest rates. In contrast, credit lines that are not based on a guarantee, such as credit cards, have higher interest rates. In some cases, the value of the collateral is higher than the value of the loan, especially when the borrower has low creditworthiness.

Let’s look at an example.

Example

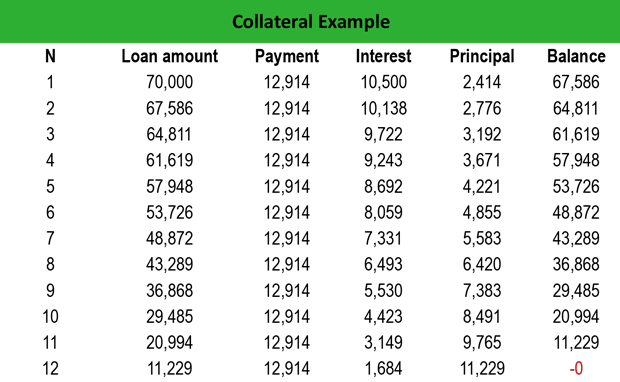

Jonathan wants to borrow $70,000. Over the past years, Jonathan was very regular with his payments, and his credit score is 740. Therefore, his banker is willing to provide Jonathan with a loan at an annual interest rate of 1.5%, which will require monthly installments of $1076.14 for a period of 12 years. From these payments, which are $7,988 annually, $10,500 will go towards interest and $2,414 will go towards the principal.

Although Jonathan is a reliable customer with high creditworthiness, the bank wants to make sure that the loan will be repaid. Therefore, Jonathan puts his house as collateral. In case Jonathan defaults on the loan, the bank can seize the property and sell it to gain the remaining funds.

Summary Definition

Define Collateral: Collateral means an item of value the a borrower places as surety to the lender that he will repay his loan.