Definition: The date of declaration is the date that a company’s board of directors votes and decides to give a cash dividend to all of the company shareholders. Once the vote is passed, a liability (dividends payable) account is setup because the board of directors actually sign a note payable to the existing shareholders in the form of a dividend. The company then owes the shareholders this money.

What Does Date of Declaration Mean?

Contents

A cash dividend is basically the company’s savings that the board of directors decides to give back to the shareholders. You might ask why would a company just give it’s money away? Well, that’s a good question. The board of directors has to weigh many different strategic options when they think about declaring dividends.

They have to make sure the company has enough operating cash as well as enough cash to invest in new operations and expansions. The board also has to take into consideration investors. Paying dividends will most like spur investors’ interest and drive the stock price up. So the decision to declare dividends really comes down to what is management’s objective.

Example

Many tech companies like Apple and Google have never given dividends up until recently. Most tech startup companies grow so fast that they need to keep their cash in order to maintain the steady business growth. Investors are attracted to these companies because of potential stock price grow. They don’t need an added dividend incentive to persuade them to invest. Companies like GE and Ford are the complete opposite. These companies have seen little grow in the last few decades and have maintained a fairly stable stock price. Investors aren’t too excited to invest in these companies without the added bonus of a dividend.

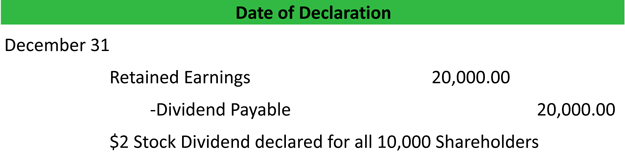

Date of Declaration General Journal Entry Example

Here is an example journal entry on the date of declaration.

Download this Download an excel version of this example.

Search for more articles about this term: