Definition: The days’ sales uncollected ratio is a liquidity ratio used by creditors and investors to estimate how many days before the company will collect their accounts receivable. In other words, the days’ sales uncollected ratio measures how long it will take for the customers to pay their credit card balances.

What Does Days’ Sales Uncollected Mean?

When was the last time you were in a department store and the cashier asked you if you wanted to open a store credit card? Pretty much every department store has its own credit card service for customers to use. Department stores do this because it works. Customers tend to buy more products if they can simply put it on a credit card.

Example

The department stores are ultimately selling more products, but they don’t actually receive the cash from the sales any quicker. Since customers are buying more products on credit, department stores end up showing large accounts receivable on their books.

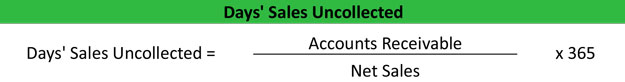

Creditors and investors in the department stores not only want to know how many sales the department store ran up but also when the cash will be collected. The days’ sales uncollected ratio divides accounts receivable by net sales and multiplies it by 365.

This ratio is important to creditors and investors because it shows when companies will actually receive the cash from its sales. Creditors are especially interested in the cash flow of the business because they want to make sure the company will have enough cash to pay off its loans on time.