Definition: The debt ratio is a financial, liquidity ratio that compares a company’s total liabilities to its total assets. The debt ratio is one of the simplest and most common liquidity ratios. The debt ratio measures how many assets a company must sell in order to pay off all of its liabilities. Companies with high debt ratios are know as highly leveraged companies.

What Does Debt Ratio Mean?

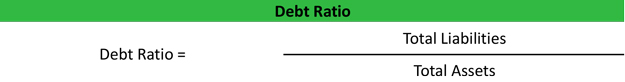

The debt ratio is calculated by dividing total liabilities by total assets.

A lower debt ratio usually implies a more stable business with the potential of longevity. Every industry has different debt ratio standards and benchmarks. Some industries, like the real estate industry, tend to borrow more money than companies in the industrial machinery industry. A debt ratio of .7 could be considered high in one industry and standard in another. In general, companies should strive for a low debt ratio.

Example

Like all liquidity ratios, the debt ratio is important to both creditors and investors. Creditors are concerned with companies’ financing strategies. Companies can either finance their asset growth with debt financing (bank loans and personal loans) or equity financing (payments from owners and stock issuances).

If a company finances too much of its assets with debt, its debt ratio will be high. Creditors view companies with higher debt ratios as riskier borrowers because the company must sell more of its assets to pay for its liabilities in liquidation. Remember creditors are only concerned about having their money repaid.

Investors are not only concerned about the debt ratio, they are also concerned about the overall debt level. More company debt means that the company has larger interest payments. Larger interest payments mean a smaller bottom line. Both investors and creditors are concerned with the stability and longevity of the company.