Definition: The debt to equity ratio is a financial, liquidity ratio that compares a company’s total debt to total equity. The debt to equity ratio shows percentage of financing the company receives from creditors and investors. A high debt to equity ratio shows that a company has taken out many more loans and has had contributions by shareholders or owners.

What Does Debt to Equity Ratio Mean?

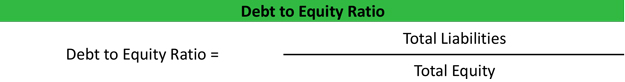

The debt to equity ratio is calculated by dividing total liabilities by total equity.

A lower debt to equity ratio usually implies a more stable business with the potential of longevity. Every industry has different debt ratio standards and benchmarks. Some industries might consider a debt to equity ratio of .5 to be high while a ratio this high might be normal in other industries. In general, companies should strive for a low debt to ratio.

Example

Companies with a higher debt to equity ratio are more risky than companies with a lower ratio. Unlike equity, debt must be repaid to the lender. Until the debts are repaid, interest payments must also be made to the lender. As you can see, debt is a far more expensive form of financing than equity. When investors or shareholders contribute money to the company, they aren’t guaranteed anything except the hopes of seeing the business grow.

A higher debt to equity ratio shows additional creditors that the investors haven’t funded the operations as much as creditors. In other words, investors don’t have as much skin in the game as the creditors do. This could mean that investors don’t want to invest additional funds into the company because the company isn’t performing well. Additional creditors also have to look at the existing creditors. In liquidation many times later creditors don’t get paid.