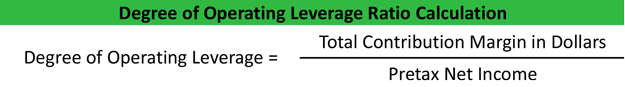

Definition: The degree of operating leverage is an efficiency ratio that shows how well companies use their fixed and variable costs to general net income. The degree of operating leverage is calculated by dividing the total contribution margin in dollars by the pretax net income.

What Does Degree of Operating Leverage Mean?

Operating leverage refers to the extent of fixed costs in a company’s overall cost structure. Companies with higher fixed costs compared with variable costs are considered to have more leverage because the higher fixed costs require more initial production in order to break even.

Since most managers want to maximize their fixed costs, they usually want to run a factory near capacity. This spreads the fixed costs over more units and reduces the fixed cost per unit.

The degree of operating leverage is a calculation that managers can use to predict the changes in pretax net income based on the how leveraged the company’s operations are.

Example

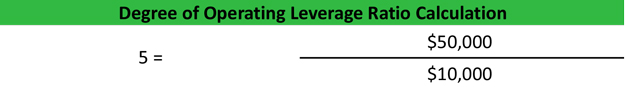

For instance, assume a company has total contribution margin in dollars of $50,000 and net income of $10,000. Their degree of operating leverage would be five.

Now the management can speculate about future performance. Given a worst-case scenario, management thinks sales could fall as much as 15 percent. Based on the current degree of operative leverage if sales fell 15 percent in the next year, the company’s pretax net income would fall 75 percent. This is calculated by the degree of operative leverage multiplied by the percentage change in sales or 5 x 15 percent.

In other words, a small change in this company’s sales could affect the bottom line drastically.