Definition: Discounted Cash Flow (DCF) analysis aims to estimate the present value of the expected future returns on an investment. If investors know the present value of their future returns, they can determine if a stock is overvalued, undervalued, or fairly valued.

What Does Discounted Cash Flow Analysis Mean?

What is the definition of discounted cash flow analysis? DCF estimates the present value of an asset or a company by discounting the operating cash flows that the firm is expected to generate in the future to determine the intrinsic value and determine if the price is enough to compensate investors for the risk they undertake.

DCF analysis uses a firm’s free cash flow (FCFF), the terminal value, and the weighted average cost of capital (WACC) at which the FCFF and the terminal value are discounted to their present values. Future cash flows are estimated for a period of 5 to 10 years, as it is very difficult to project cash flows for a longer period.

Let’s look at an example.

Example

Todd is a financial analyst at company ABC. He is asked to perform a DCF analysis and calculate the firm’s fair value.

- Capital structure: debt 65% – equity 35%

- Cost of debt (Kd): 7.70%

- Cost of equity (Ke): 14.60%

- Growth to perpetuity: 2%

- Tax rate: 30%

Todd calculates the WACC = (Wd x Kd) + (We x Ke) = (65% x 7.70%) + (35% x 14.60%) = 5.01% + 5.11% = 10.12%

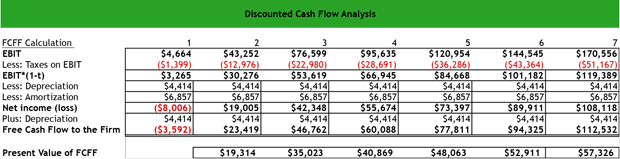

Then, he calculates the FCFF by discounting the FCFF by the WACC as follows:

For example, in year 2, the present value of the FCFF is 23,419 / (1 +10.12% )2 = 19,314.

In year 3, the present value of the FCFF is 46,762 / (1+10.12% )3 = 35,023 and so on.

Then, he calculates the Terminal Value by using the FCFF of year 7 and discounts it by the WACC as follows:

Terminal value = FCFF * ( 1+ g ) / ( WACC-g) = $112,532 * ( 1 + 0.02 ) / (0.1012 – 0.02 ) = $114,783 / 0.0812 = $1,442,742

The terminal value discounted by the WACC = $1,442,742 / (1+10.12%)7 = $734,959

Therefore, the fair value of the firm = PV of FCFF and PV of the terminal value = $253,507 + $734,959 = $988,466

Summary Definition

Define Discounted Cash Flows Analysis: DCF is an evaluation method used by investors to estimate the present value of the future cash inflows of an investment in order to determine whether the investment is worth it or not.