Definition: Diversification is a growth strategy that capitalizes on market opportunities by allocating investment risk over different asset classes.

What Does Diversification Mean?

What is the definition of diversification? Diversification is an asset allocation plan, which properly allocates assets among different types of investment. Investors accept a certain level of risk, but they also need to have an exit strategy, if their investment does not generate the expected return.

Hence, by constructing a well-diversified portfolio, they protect their investments, while allowing a potential for growth. Also, the proper asset allocation, allows them to leverage investment risk and portfolio volatility as each asset is expected to react differently to various market conditions.

Let’s look at an example.

Example

Alexander invests $100,000 in a diversified portfolio. To achieve optimal portfolio diversification, he considers the existing market realities, and he effectively assesses the relationship between risk and return. So, he invests in relatively safe investments that generate long-term returns.

Alexander’s diversification strategy is the following:

a) He includes 10 to 12 diversified stocks on average from different industries, sectors and geographical region. By diversifying his portfolio mix, he leverages risk.

b) He includes investments that incur different levels of risk. For instance, when stock prices decline, bond prices rise because an increasing number of investors shift their money to bonds for greater safety. If the stock market declines, a portfolio consisting of stocks and bonds is expected to perform differently than a portfolio consisting of stocks only.

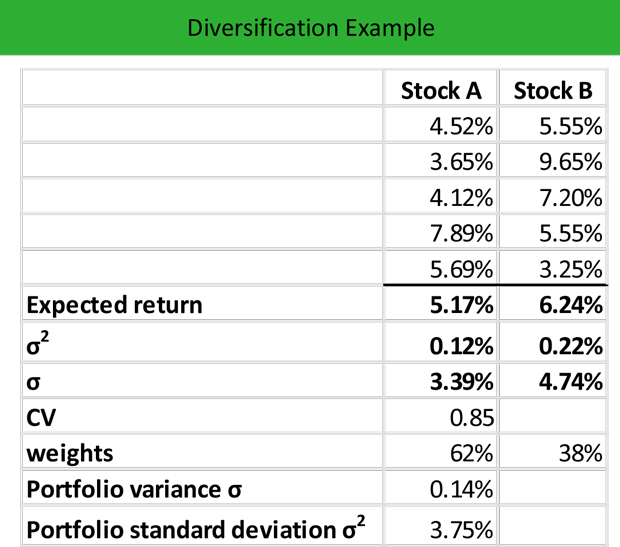

c) He calculates the standard deviation of his diversified portfolio. Ideally, the standard deviation of the portfolio is lower than the standard deviation of each individual asset. For example, assume the following returns of two stocks of a diversified portfolio:

If stock A has an average expected return of 5.17% and stock B has an average expected return of 6,24%, the portfolio standard deviation is 3,75% (check out the Portfolio Standard Deviation article on how to calculate the standard deviation of a portfolio). In this case, the portfolio standard deviation is higher than the standard deviation of each stock. Therefore, knowing the standard deviation of the portfolio can lower the portfolio volatility.

Summary Definition

Define Diversification: Diversifying means maintaining different types investments in a portfolio in an effort to mitigate risk.