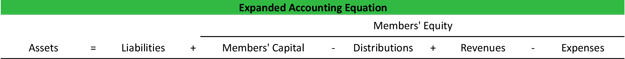

Definition: The expanded accounting equation takes the simple accounting equation (assets = liabilities + owner’s equity) and adds additional equity items to show how they affect the company as a whole. The equity account is split into four or five main sub-categories that differ between partnerships and corporations.

What Does Expanded Accounting Equation Mean?

The first subcategory represents the owner’s stake in the business. The second shows how much money the owners took out of the company. The third and fourth items represent the income and expenses for the year.

Example

An expanded accounting equation for a partnership breaks out the equity section to include owner’s capital, owner’s withdrawals, revenues and expenses. Thus, equity = capital – withdrawals + revenues – expenses. Since partnerships rarely have a single member, the equation shows the total of all capital accounts and all withdrawals taken during the year. The total equation looks like this.

A corporation, on the other hand, includes a few more items in the equity section than a partnership. An expanded accounting equation for corporation breaks out equity into common stock, retained earnings additional paid in capital, treasury stock, dividends distributed, revenues and expenses. Thus, the corporate equity equals outstanding common stock + retained earnings + paid in capital – treasury shares – dividends + revenues – expenses. The entire corporate equation looks like this.

![]()

You might ask what’s the problem with the original accounting equation? Why change it? Well the expanding formula shows the relationship between the income statement and the balance sheet. In other words, it shows how the income and expense accounts flow through the equation and eventually end up being reported on the equity section of the balance sheet at the end of the accounting cycle.

It also gives more explanation for how journal entries can affect different accounts. For example, some students have trouble learning the concepts retained earnings and paid in capital. This equation helps demonstrate them in more detail.