Definition: A hedge fund (HF) is a type of alternative investment that seeks to generate high returns by investing in a pool of underlying securities. In other words, it’s a group of investors funds pooled together to purchase investments.

What Does Hedge Fund Mean?

What is the definition of hedge fund? Hedge funds implement a range of different strategies, including long and short positions to leverage (hedge) investment risk and capitalize on investment opportunities. By opening a long position, a HF is buying stocks, whereas by opening a short position, the HF is borrowing the underlying asset, and it sells the stocks to buy them later at a lower price.

Hedge fund strategies are classified based on what they seek to achieve and on the investment profile of the investor. Although currently not regulated by the U.S. Securities and Exchange Commission (SEC), they may invest in securities, bonds, derivatives, and real estate assets, offering geographical diversification as well as exposure to the domestic markets.

Let’s look at an example.

Example

Michael is a hedge fund manager at Barclays. He manages a portfolio of assets for different institutional clients, and he implements different strategies for each client depending on his investment profile. As a HF manager, Michael is responsible for overseeing the investments that he selects for his clients as well as to make appropriate decisions for achieving a high return on investment. Sometimes, he faces the opposition of a client, especially in the cases that a portfolio has incurred losses, so Michael is extremely careful in the HF strategies he chooses for each portfolio.

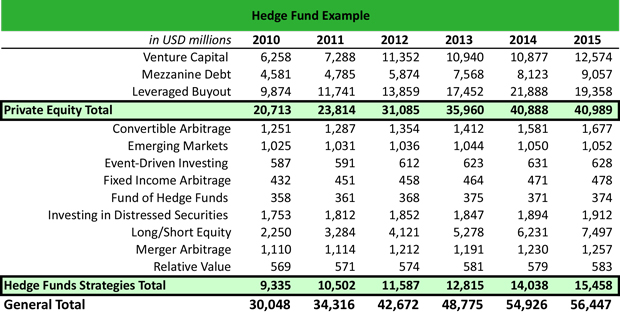

To have a clear picture of the HF strategies implemented since 2010, Michael constructs an excel spreadsheet as follows:

As a HF manager, Michael is entitled to management fees for covering the fund’s operating expenses, and performance fees, thereby gaining a large share of the hedge fund’s profits. In this context, Michael, as any other HF manager has a personal interest in realizing a profit from the investment choices he makes for his clients.

Summary Definition

Define Hedge Funds: Hedge fund means an investment house that pools funds to invest in land, buildings, securities, or currencies.