Definition: An operating lease is a short-term lease or contract in which the lessee agrees to rent an asset from the lessor and the lessor retains the rights of ownership. In other words, an operating lease is a lease that is less than one year in length and the lessor always maintains ownership of the leased asset. Operating leases are also cancelable unlike capital leases.

What Does Operating Lease Mean?

The majority of business leases are operating leases because they are easy to set up and don’t require a large commitment. Vehicle leases, building leases, and equipment leases all can qualify as an operating lease.

Essentially an operating lease is simply an agreement to rent an asset without a buyout option. When a retail business agrees to rent a storefront in a plaza strip, it usually signs a lease for 6-12 months. The retailer pays rent to the lessor every month until the lease contract is up. After the lease is over, the retail store does not own the storefront and can either sign another lease or stop leasing the storefront.

This is in contrast with capital leases, which does pass ownership rights to the lessee after the lease is over.

Example

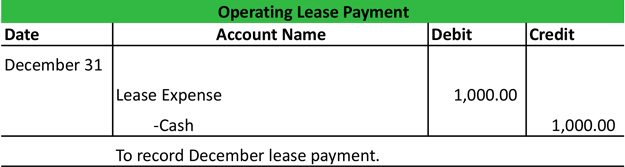

Operating leases are accounted for just like any rental payments. When the lease is signed, no assets or liabilities are added to the books. The lessee simply records the monthly lease payment as a debit to lease or rent expense and a credit to cash. No other journal entries are necessary.