Definition: Paid in Capital is the amount of cash or other assets that owners put into a company for stock. Notice that paid in capital can exist with either a contribution of cash or assets. This is particularly important for new and start up corporations.

A lot of time new companies don’t need cash as much as they need equipment. Investors can contribute equipment and receive stock in exchange. Whenever investors or current shareholders contribute money to a corporation, paid in capital is created, but what is paid in capital in excess of par?

What Does Paid-In Capital in Excess of Par Mean?

Paid in capital in excess of par is essentially the difference between the fair market value paid for the stock and the stock’s par value. In other words, it’s the premium paid for an appreciated stock. Paid in capital in excess of par is created when investors pay more for their shares of stock than the par value.

Example

For instance, Joe decides to buy 100 shares of Orange Guitars, Inc. for $1,000. Orange Guitars, Inc. par value is only $1 per share. This means that Joe paid $9 per share more than the par value of the stock. This payment in excess of the par value is recorded in its own equity account called paid in capital in excess of par.

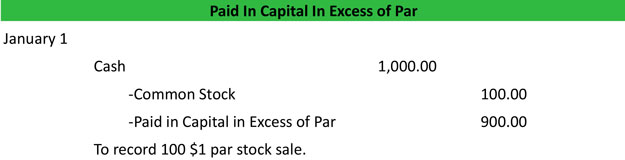

So Orange Guitars, Inc. would debit cash for the $1,000 and credit common stock for the $1 par value of $100 and credit paid in capital in excess of par for $900. Here is what the journal entry to record the stock issuance would look like.

Download this accounting example in excel.