Definition: The quick ratio is a financial liquidity ratio that compares quick assets to current liabilities. Quick assets generally include cash, cash equivalents, and accounts receivable.

What Does Quick Ratio Mean?

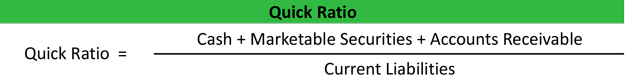

The quick ratio is calculated by adding all the quick assets together and dividing by the total current liabilities. Here is the quick ratio equation.

The quick ratio is designed to show investors and creditors how quickly a company can pay off its short-term debt. Assets like cash, marketable securities, and accounts receivable can quickly be converted into cash and used to pay off current liabilities. This also shows analysts that the company has healthy cash flow and can meet its short-term debt obligations with its operations. In other words, the company is making enough profit to pay off its current liabilities without having to sell long-term assets.

Example

At the end of the year, Jim’s Computer Repair Shop has $100 in cash, $150 in stock investments, $50 in accounts receivable, and accounts payable of $200 with no other liabilities. Jim would calculate his quick ratio like this.

Jim’s quick ratio is 1.5. That means that Jim has 1.5 times as many quick assets as current liabilities. In other words, Jim could pay off all of his current liabilities with only 66% of his quick assets. This is a high quick ratio and shows that Jim has a liquid business with fair cash flow.

Creditors generally look at the quick ratio to analyze whether a company will be able to pay long-term debt as it comes due. Jim’s shop should have no problem with this.