Definition: The security market line (SML) presents the capital asset pricing model (CAPM) on a graph, seeking to demonstrate the levels of market risk based on the hypothesis of a perfect market.

What Does SML Mean?

What is the definition of security market line? Based on the risk that different market securities incur, the SML estimates the future expected returns under the assumption that risk and return are moving in the same direction. Therefore, risk-averse investors choose investment close to the beginning of the line, where the risk is zero, whereas risk-taker investors choose investments close to the highest point of the SML line, where the risk is higher.

The securities that are plotted above the SML, i.e. the risk-free rate, are undervalued because their expected return compared to their risk is low. Conversely, the securities that are plotted below the SML are overvalued because their expected return compared to their risk is high.

To calculate the SML we need to know the risk-free rate (rf), the best of the stock (b), the expected return of the market (ERM) and the expected return on investment (ERs).

Let’s look at an example.

Example

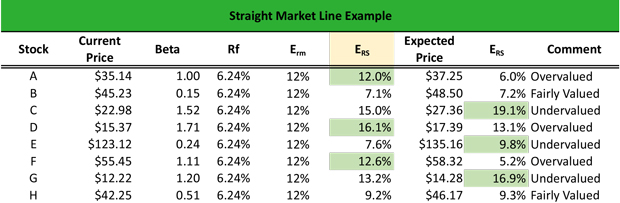

Joan is a financial analyst. She is asked to determine if a set of stocks is undervalued, overvalued or fairly valued using the SML formula. The risk-free rate is 6.245 and the expected return of the market is 12%. Based on the beta of each stock, Joan calculates the following expected return, as follows:

- ERsA = Rf + b x (ERm – Rf) = 6.24% + 1 x (12% – 6.24) = 12.0%

- ERsB = Rf + b x (ERm – Rf) = 6.24% + 0.15 x (12% – 6.24) = 7.1%

- ERsC = Rf + b x (ERm – Rf) = 6.24% + 1.52 x (12% – 6.24) = 15.0%

- ERsD = Rf + b x (ERm – Rf) = 6.24% + 1.71 x (12% – 6.24) = 16.1%

- ERsE = Rf + b x (ERm – Rf) = 6.24% + 0.24 x (12% – 6.24) = 9.8%

- ERsF = Rf + b x (ERm – Rf) = 6.24% + 1.11 x (12% – 6.24) = 12.6%

- ERsG = Rf + b x (ERm – Rf) = 6.24% + 1.20 x (12% – 6.24) = 13.1%

- ERsH = Rf + b x (ERm – Rf) = 6.24% + 0.51 x (12% – 6.24) = 9.2%

- ERsA = Rf + b x (ERm – Rf) = 6.24% + 1 x (12% – 6.24) = 12.0%

Then, she creates an Excel spreadsheet, where she includes all the above information, and she calculates the expected returns of each stock based on research analysis to compare them with the ones of the SML equation, as follows:

Therefore: based on Joan’s calculations, there are three overvalued stocks (A, D and F), three undervalued stocks (C, E and G), and two fairly valued stocks (B and H).

Summary Definition

Define Security Market Line: SML means a graphical representation of the expected rate of return of an investment adjusted for systematic risk.