Definition: Times interest earned is the financial ratio that compares interest before interest expense and taxes to the total interest expense. Time interest earned ratio measures the ability of a company to pay its interest expense based on its current income levels.

What Doe Times Interest Earned Mean?

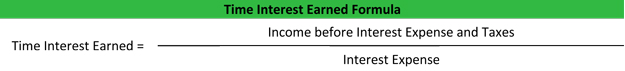

Time interest earned ratio is calculated by dividing income before interest expense and taxes by the total interest expense. Here is the formula.

Example

Creditors and managers tend to look at the time interest earned ratio see whether the company can support additional debt. Some companies are so highly leveraged with debt that interest payments and debt servicing makes up a large percentage of their income. Creditors view a company with a high time interest earned ratio as risky because it is less likely that the company will be able to make additional interest payments.

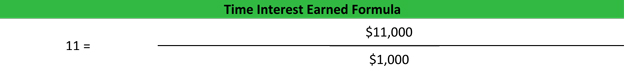

For instance, a retail company needs an additional loan from a bank to update its retail storefront. The bank asks for the stores income and current interest levels. The company had net income of $10,000 and interest expense of $1,000. This means that the company’s income before interest expense equals $11,000. The time interest earned ratio is calculated like this.

The retailer’s ratio of 11 means that the company can pay for its interest expense 11 times over with its current income levels. Creditors would typically view this as not risky and the retail company would probably get approved for its loan.

The retail store managers must use the time interest earned ratio to plan sustainable debt levels for future expected sales. For instance, if management anticipates an decrease in sales in the future, it should try to decrease its time interest earned ratio as well.