Definition: Wage bracket withholding tables are used to calculate the amount of income that the employer must withhold from each employee’s paycheck.

What Does Wage Bracket Withholding Table Mean?

The IRS and US tax laws require employers to withhold employee’s for income tax purposes. The employer is required to withhold a certain amount of income from its employees and remit that money to the federal government.

When the federal government receives the payments made by the employer, each employee is credited with their portion of income taxes paid. Throughout the year, the income tax withholdings are reported on each employee’s pay stub and reported on each employee’s W-2 at the end of the year.

Example

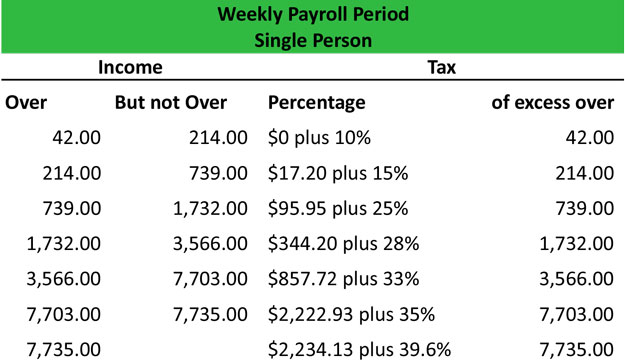

A wage bracket withholdings table usually has income numbers in the far left column and income tax withholding numbers in the columns to the right. Above all the income tax withholding columns are dependent allowance claims. Each employee fills out a W-4 that indicates how many dependents the employee is anticipating on claiming for the tax year as well as the employee’s filing status.

The employer then matches the income numbers on the left with the dependent number in the top row to find the amount of income taxes that must be withheld for that pay period. Here is an example of a weekly wage bracket withholding table. Wage bracket withholding tables are also available in bi-weekly, monthly, quarterly, semi-annual, and annual tables.

Download this accounting example in excel.

Since modern computer systems and software have become popularized, manual wage tables like this are uncommon. Most companies rely on bookkeeping software or payroll companies to compute the necessary amount of payroll tax withholdings.