Definition: A depreciation schedule breaks down the depreciation of the firm’s long-term assets. It calculates the depreciation expense for each asset and allocates the cost of each asset over the useful life. Accountants use these schedules not only to compute the expense, they also use it to track beginning and ending accumulated depreciation.

What Does Depreciation Schedule Mean?

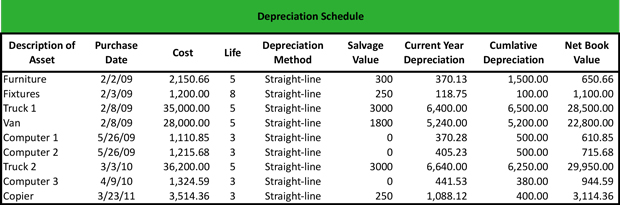

What is the definition of depreciation schedule? A depreciation schedule enables firms to keep track of their long-term assets and see how these are going to depreciate over time. Usually, the information that a depreciation schedule includes is a description of the asset, the date of purchase, how much it costs, how long the firm estimates to use the asset (life), and the value of the asset when the firm decides to replace it (salvage value).

Furthermore, the depreciation schedule presents information on the depreciation method, the depreciation of the current year, the cumulative depreciation from the date the firm purchased the asset until today, and the net book value.

Let’s look at an example.

Example

Theo is working at a firm’s accounting department. He is asked to create a schedule using the straight-line depreciation method and present the results to his manager.

Theo knows that depreciation can be claimed for assets with a useful life of at least one year, can become obsolete and are used for business purposes. Such assets are computers, equipment, vehicles, office furniture, and buildings.

He decides to use the straight-line method, which spreads the expenses of an asset evenly over its useful life after subtracting the asset’s salvage value.

Therefore, straight-line depreciation method = (Cost – Salvage Value) // Life. Furthermore, the straight-line depreciation method allows Theo to make an approximate estimate of the expected economic benefits over an asset’s useful life.

Based on the above, Theo creates the depreciation schedule by including the following information:

- Description of asset

- Date of purchase

- Cost

- Expected life

- Depreciation method

- Salvage value

- Current year depreciation

- Cumulative depreciation

- Net book value = Cost – Cumulative Depreciation

Summary Definition

Define Depreciation Schedule: A depreciation schedule is a chart that calculates an assets depreciation expenses based on its purchase date, cost, useful life, and method.