Debit vs Credit – What’s the Difference?

Contents

The double entry accounting system is based on the concept of debits and credits. This is an area where many new accounting students get confused. Often people think debits mean additions while credits mean subtractions. This isn’t the case at all.

Debits and credits actually refer to the side of the ledger that journal entries are posted to. A debit, sometimes abbreviated as Dr., is an entry that is recorded on the left side of the accounting ledger or T-account. Conversely, a credit or Cr. is an entry on the right side of the ledger.

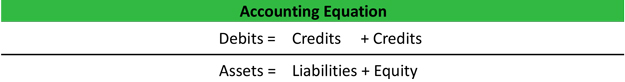

This right-side, left-side idea stems from the accounting equation where debits always have to equal credits in order to balance the mathematically equation.

If you will notice, debit accounts are always shown on the left side of the accounting equation while credit accounts are shown on the right side. Thus, debit entries are always recorded on the left and credit entries are always recorded on the right.

So debits and credits don’t actually mean plusses and minuses. Instead, they reflect account balances and their relationship in the accounting equation.

Debit and Credit Accounts and Their Balances

There are several different types of accounts in an accounting system. Each account is assigned either a debit balance or credit balance based on which side of the accounting equation it falls. Here are the main three types of accounts.

Assets

All normal asset accounts have a debit balance. This means that asset accounts with a positive balance are always reported on the left side of a T-Account. Assets are increased by debits and decreased by credits.

Liabilities

All normal liabilities have a credit balance. In other words, these accounts have a positive balance on the right side of a T-Account. Liabilities are increased by credits and decreased by debits.

Equity Accounts

Equity accounts like retained earnings and common stock also have a credit balances. This means that equity accounts are increased by credits and decreased by debits.

Contra Accounts

Notice I said that all “normal” accounts above behave that way. Well, what is an un-normal account? Contra accounts are accounts that have an opposite debit or credit balance. For instance, a contra asset account has a credit balance and a contra equity account has a debit balance. These accounts are used to reduce normal accounts. For example, accumulated depreciation is a contra asset account that reduces a fixed asset account.

Credit vs Debit Examples

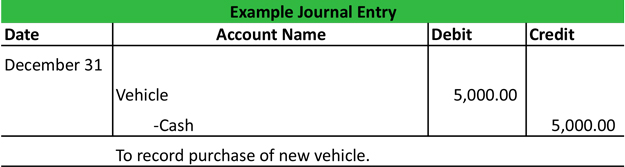

— Bob’s Furniture needs to buy a new delivery truck because their current truck is started to fall apart. Bob purchases the new truck for $5,000, so he writes a check to the car company and receives the truck in exchange. Bob’s cash is being reduced by the $5,000 and his fixed assets are being increased by $5,000. Bob would record this entry like this:

As you can see, Bob’s cash is credited (decreased) and his vehicles account is debited (increased).

— Now let’s take the same example as above except let’s assume Bob paid for the truck by taking out a loan. Bob’s vehicle account would still increase by $5,000, but his cash would not decrease because he is paying with a loan. Instead, his liabilities account would increase.

As you can see, Bob’s liabilities account is credited (increased) and his vehicles account is debited (increased).

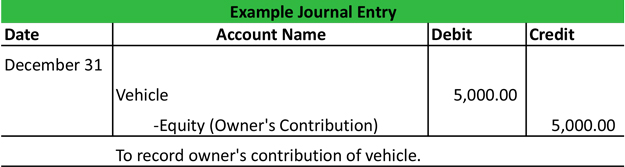

— Now let’s assume that Bob’s Furniture didn’t purchase the truck at all. It couldn’t afford to buy a new one, so Bob just contributed his personal truck to the company. In this case, Bob’s vehicle account would still increase, but his cash and liabilities would stay the same. Bob’s equity account would increase because he contributed the truck.

As you can see, Bob’s equity account is credited (increased) and his vehicles account is debited (increased).