What is the General Ledger?

Contents

A general ledger or accounting ledger is a record or document that contains account summaries for accounts used by a company. In other words, a ledger is a record that details all business accounts and account activity during a period. Remember our notebook analogy in the account explanation? You can think of an account as a notebook filled with business transactions from a specific account, so the cash notebook would have records of all the business transactions involving cash.

By this same analogy, a ledger could be considered a folder that contains all of the notebooks or accounts in the chart of accounts. For instance, the ledger folder could have a cash notebook, accounts receivable notebook, and notes receivable notebooks in it. In a sense, a ledger is a record or summary of the account records.

A ledger is often referred to as the book of second entry because business events are first recorded in journals. After the journals are complete for the period, the account summaries are posted to the ledger.

List of General Ledger Accounts and Content

Accounting Ledger

The general ledger is often called the accounting ledger because it contains a listing of all general accounts in the accounting system’s chart of accounts. Here are the main types of general ledger accounts:

- Asset Accounts (Cash, Accounts Receivable, Fixed Assets)

- Liability Accounts (Accounts Payable, Bonds Payable, Long-Term Debt)

- Stockholders’ Equity Accounts (Common Stock, Retained Earnings)

- Revenue Accounts (Sales, Fees)

- Expense Accounts (Wages Expense, Utilities Expense, Depreciation Expense)

- Other Gain and Loss Accounts (Interest Expense, Investment Income, Gain/Loss on Disposal of Asset)

These accounts are debited and credited to record transactions throughout the year. Most modern companies use a computerized GL, like the one in Quickbooks software packages, to track their business transactions. This way reports can be automatically generated and there

Example

How to Use the General Ledger

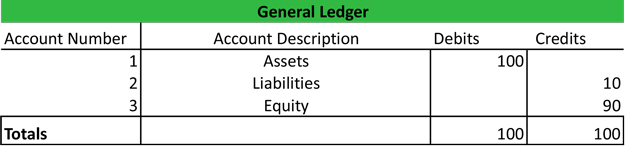

Accounts are usually listed in the general ledger with their account numbers and transaction information. Here is what an general ledger template looks like in debit and credit format.

As you can see, columns are used for the account numbers, account titles, and debit or credit balances. The debit and credit format makes the ledger look similar to a trial balance. Other ledger formats list individual transaction details along with account balances.

Accounting ledgers can be displayed in many different ways, but the concept is still the same. Ledgers summarize the balances of the accounts in the chart of accounts.

Subsidiary Ledgers

The general ledger is not the only ledger in an accounting system. Subsidiary ledgers include selective accounts unlike the all-encompassing general ledger. Sometimes subsidiary ledgers are used as an intermediate step before posting journals to the general ledger.

For instance, cash activity is usually recorded in the cash receipts journal. The account details can then be posted to the cash subsidiary ledger for management to analyze before it gets posted to the general ledger for reporting purposes.

Now let’s move on to talk about debits vs. credits and how they work in an accounting system.