Definition: A capital expenditure (CAPEX) is an expense that a company makes towards the purchase of new equipment or the improvement of its long-term assets, namely property, plant, and equipment.

What Does Capital Expenditure Mean?

What is the definition of capital expenditure? CAPEX usually pertains to maintenance expenditures that seek to extend the useful life of the company’s assets through repair or upgrade or to expansion expenditures that the company makes when seeking expansion of its product line, entry in a new market or acquisition of a new business.

Long-term assets are a company’s land, buildings, machinery, vehicles, furniture, computers, office equipment, software as well as patents, trademarks, and licenses. Companies report CAPEX on the cash flow statement and are amortized over the life of the related asset because, usually, the asset’s useful life is longer than the taxable year and, therefore, CAPEX cannot be reported as an expense.

Let’s look at an example.

Example

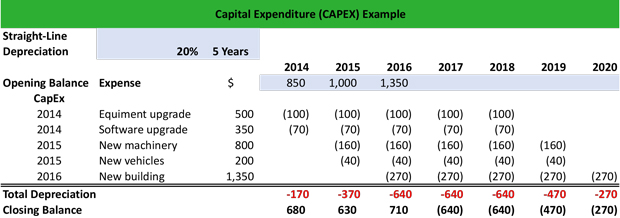

Alexander works as an accountant in a manufacturing company. The company has made several capital expenditures over the past three years, and Alexander wants to construct a straight-line depreciation schedule to amortize CAPEX accordingly. In 2014, the company spent $500,000 for equipment upgrade and $350,000 for a software upgrade. In 2015, it acquired new vehicles for $200,000 and spent $800,000 for new machinery to increase capacity. On February 2016, the company acquired a new building for $1.35 million.

Alexander records the expenses that the company has made between 2014 and 2016 and uses the straight-line depreciation method to assess the impact of the depreciation expenses on the company’s net income.

Capital expenditures affect the income statement indirectly. For example, in the above case, the net income will be lowered by the depreciation amount over the useful life of each asset. Yet, as the investment in the new machinery is likely to increase the company’s sales, the net income may actually increase, even after deducting depreciation. Alternatively, the utility expense may rise, thereby lowering the net income. So, at the end of the day, CAPEX affects net income in different ways.

Summary Definition

Define Capital Expenditure: CAPEX means the purchase of a fixed asset that has a useful life of more than one year.