Definition: The contribution margin income statement separates variable and fixed costs in an effect to show external users the amount of revenues left over after variable costs are paid. In other words, this is a special income statement format that lists variable costs and fixed costs in order to calculate the contribution margin of the company.

What Does Contribution Margin Income Statement Mean?

What is the definition of contribution margin income statement? This financial statement is particularly helpful for management accountants analyzing how production costs change as production levels increase. This is also a measure of risk in the production process. For instance, if the fixed-costs are extremely high, the company must manufacture and sell many more units to cover both of the fixed and variable-costs. As the production increases, so do the variable-costs. Thus, only a percentage of the additional revenues go toward paying for the fixed-costs.

Format

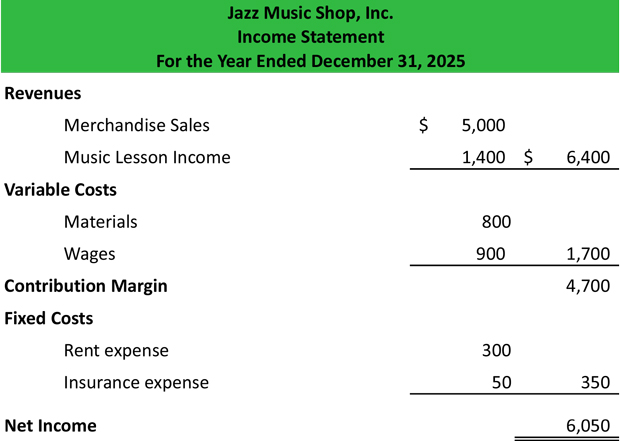

Here is the typical contribution margin income statement format.

Depending on the presentation variable-costs could be broken out into two categories: production expenses and selling / administrative expenses. Likewise, fixed-costs are often separated into the same two categories.

As you can see, this format is very different from the traditional income statement format because cost of goods sold is not listed and gross margin is not calculated on the report. Instead variable-costs are listed and the contribution margin is calculated.

Example

This format helps external users see how much of the revenues are dedicated to variable-costs and the amount of fixed-costs that the company is committed to. Different industries have different benches for these numbers. For example, the soft drink industry is highly automated. In fact, Coca Cola’s assembly line only requires one employee to run the filling station that fills more than 2,000 soda cans a minute. That’s a ton of automation. Coke’s variable-costs are much lower than their fixed-costs because they have so much invested in automation.

Conversely, industries with less automation, higher labor requirements, and higher material costs would have much lower variable-costs than fixed-costs. This distinction is important to both management and external users because fixed-costs are constant and variable-costs can change with the overall production levels.

For instance, a company with zero sales would theoretically have zero variable-costs and no margin. The fixed-costs would still remain, however, creating a loss for the year.

Summary Definition

Define Contribution Margin Income Statement: Contribution Profit and Loss means a P&L statment that separates variable and fixed costs.