Definition: A noninterest-bearing note is a note or bond with no stated interest rate on its face. Contrary to the name, noninterest-bearing notes do actually pay interest. The interest is implied in the face value of the note.

What Does Non-Interest Bearing Note Mean?

A noninterest-bearing note works the same way a discounted bond works. The note is issued for a lessor amount than the face value. After the note matures the entire face value is repaid. It might be easier to look at an example.

Example

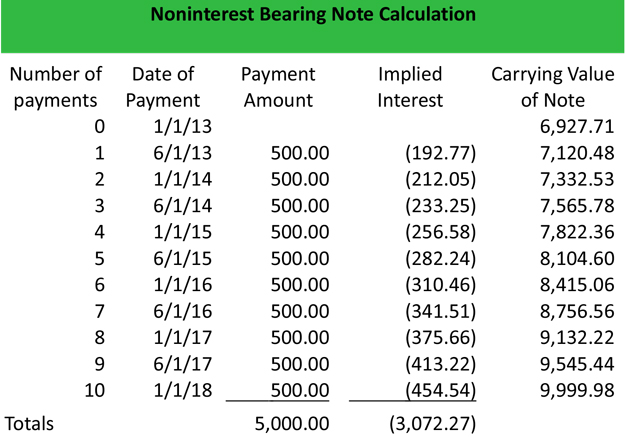

Big Ben’s Machining is looking for financing to expand its machine plant. It decides to talk with a bank about long-term notes. Big Ben and his bank settle on a noninterest-bearing 5%, $10,000, 10-year note with $500 monthly payments. The bank writes Big Ben a check for $6,927.71. At the end of the 10 years Big Ben will have paid the bank back the full $10,000. Here is a table that shows the noninterest bearing note calculations.

Download this accounting example in excel to help calculate your own bond interest problems.

As you can see, the note actually pays interest over the course of its life. The interest is just built into the amount borrowed. The cool thing about noninterest-bearing notes is that you can easily calculate the total interest expense. The total interest is the just the face value minus the amount received.

In Big Ben’s case, the total interest expense over the life of the note would be $3,072.29 or $10,000 – $6,927.71.

If Big Ben actually needed $10,000 in order to purchase his new piece of equipment, he would have to take out a $33,906.13 note with the same interest and payment amounts.