What is a Journal Entry?

Contents

Journal entries are the first step in the accounting cycle and are used to record all business transactions and events in the accounting system. As business events occur throughout the accounting period, journal entries are recorded in the general journal to show how the event changed in the accounting equation. For example, when the company spends cash to purchase a new vehicle, the cash account is decreased or credited and the vehicle account is increased or debited.

How to Make a Journal Entry

Here are the steps to making an accounting journal entry.

1. Identify Transactions

There are generally three steps to making a journal entry. First, the business transaction has to be identified. Obviously, if you don’t know a transaction occurred, you can’t record one. Using our vehicle example above, you must identify what transaction took place. In this case, the company purchased a vehicle. This means a new asset must be added to the accounting equation.

2. Analyze Transactions

After an event is identified to have an economic impact on the accounting equation, the business event must be analyzed to see how the transaction changed the accounting equation. When the company purchased the vehicle, it spent cash and received a vehicle. Both of these accounts are asset accounts, so the overall accounting equation didn’t change. Total assets increased and decreased by the same amount, but an economic transaction still took place because the cash was essentially transferred into a vehicle.

3. Journalizing Transactions

After the business event is identified and analyzed, it can be recorded. Journal entries use debits and credits to record the changes of the accounting equation in the general journal. Traditional journal entry format dictates that debited accounts are listed before credited accounts. Each journal entry is also accompanied by the transaction date, title, and description of the event. Here is an example of how the vehicle purchase would be recorded.

Since there are so many different types of business transactions, accountants usually categorize them and record them in separate journal to help keep track of business events. For instance, cash was used to purchase this vehicle, so this transaction would most likely be recorded in the cash disbursements journal. There are numerous other journals like the sales journal, purchases journal, and accounts receivable journal.

Example

We are following Paul around for the first year as he starts his guitar store called Paul’s Guitar Shop, Inc. Here are the events that take place.

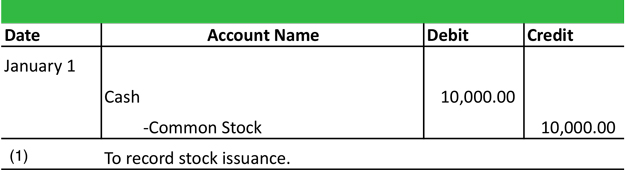

Entry #1 — Paul forms the corporation by purchasing 10,000 shares of $1 par stock.

Entry #2 — Paul finds a nice retail storefront in the local mall and signs a lease for $500 a month.

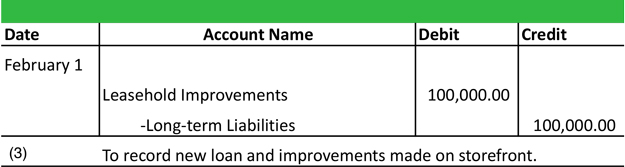

Entry #3 — PGS takes out a bank loan to renovate the new store location for $100,000 and agrees to pay $1,000 a month. He spends all of the money on improving and updating the store’s fixtures and looks.

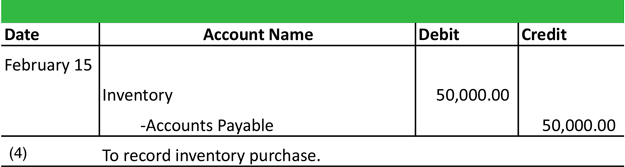

Entry #4 — PGS purchases $50,000 worth of inventory to sell to customers on account with its vendors. He agrees to pay $1,000 a month.

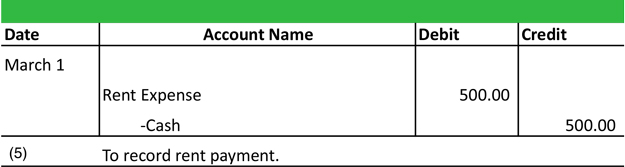

Entry #5 — PGS’s first rent payment is due.

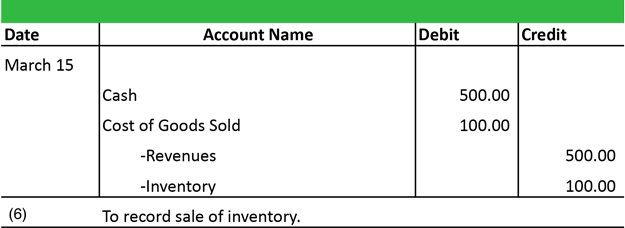

Entry #6 — PGS has a grand opening and makes it first sale. It sells a guitar for $500 that cost $100.

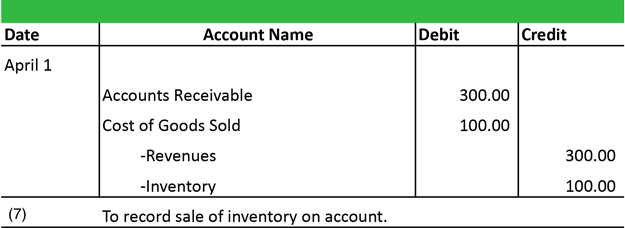

Entry #7 — PGS sells another guitar to a customer on account for $300. The cost of this guitar was $100.

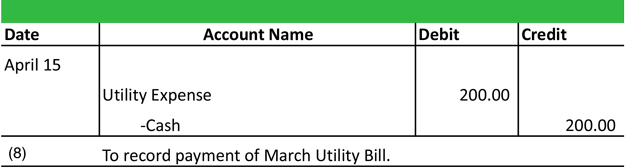

Entry #8 — PGS pays electric bill for $200.

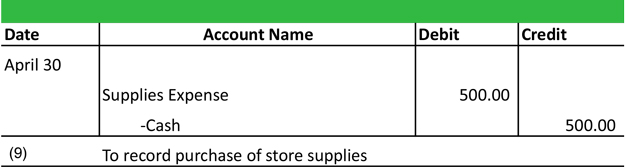

Entry #9 — PGS purchases supplies to use around the store.

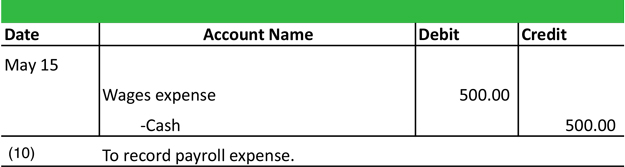

Entry #10 — Paul is getting so busy that he decides to hire an employee for $500 a week. Pay makes his first payroll payment.

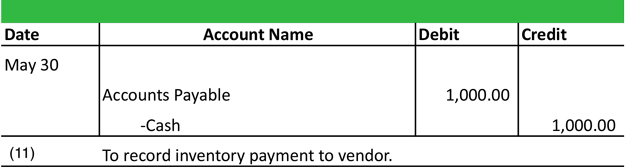

Entry #11 — PGS’s first vendor inventory payment is due of $1,000.

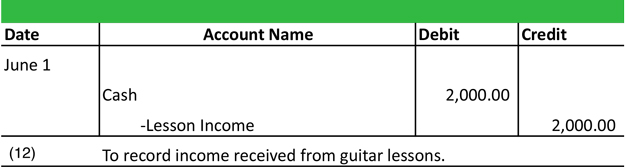

Entry #12 — Paul starts giving guitar lessons and receives $2,000 in lesson income.

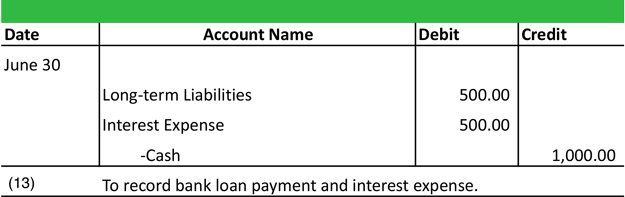

Entry #13 — PGS’s first bank loan payment is due.

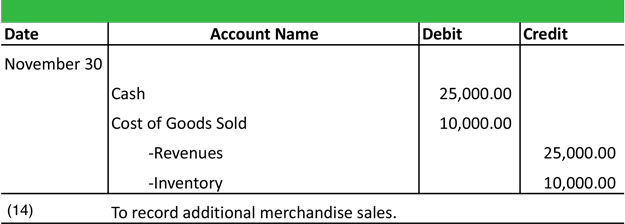

Entry #14 — PGS has more cash sales of $25,000 with cost of goods of $10,000.

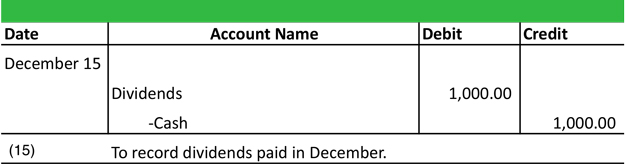

Entry #15 — In lieu of paying himself, Paul decides to declare a $1,000 dividend for the year.

Now that these transactions are recorded in their journals, they must be posted to the T-accounts or ledger accounts in the next step of the accounting cycle.

Here is an additional list of the most common business transactions and the journal entry examples to go with them.

Common Journal Entry Questions

What is a manual Journal Entry?

Manual journal entries were used before modern, computerized accounting systems were invented. The entries above would be manually written in a journal throughout the year as business transactions occurred. These entries would then be totaled at the end of the period and transferred to the ledger. Today, accounting systems do this automatically with computer systems.

What is a general journal entry in accounting?

An accounting journal entry is the written record of a business transaction in a double entry accounting system. Every entry contains an equal debit and credit along with the names of the accounts, description of the transaction, and date of the business event.

What is the purpose of a journal and ledger?

The purpose of an accounting journal is record business transactions and keep a record of all the company’s financial events that take place during the year. An accounting ledger, on the other hand, is a listing of all accounts in the accounting system along with their balances.

What is the purpose of a journal entry?

A journal entry records financial transactions that a business engages in throughout the accounting period. These entries are initially used to create ledgers and trial balances. Eventually, they are used to create a full set of financial statements of the company.