What are Adjusting Journal Entries (AJE)?

Contents

Adjusting entries, also called adjusting journal entries, are journal entries made at the end of a period to correct accounts before the financial statements are prepared. This is the fourth step in the accounting cycle. Adjusting entries are most commonly used in accordance with the matching principle to match revenue and expenses in the period in which they occur.

Types of Adjusting Entries

There are three different types of adjusting journal entries as follows:

- Prepayments

- Accruals

- Non-cash expenses

Each one of these entries adjusts income or expenses to match the current period usage. This concept is based on the time period principle which states that accounting records and activities can be divided into separate time periods.

In other words, we are dividing income and expenses into the amounts that were used in the current period and deferring the amounts that are going to be used in future periods.

Why are Adjusting Entries Necessary?

What Does an Adjusting Journal Entry Record?

Here are the main financial transactions that adjusting journal entries are used to record at the end of a period.

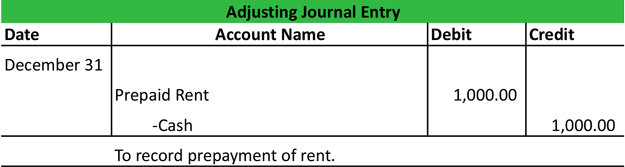

Prepaid expenses or unearned revenues – Prepaid expenses are goods or services that have been paid for by a company but have not been consumed yet. Insurance is a good example of a prepaid expense. Insurance is usually prepaid at least six months. This means the company pays for the insurance but doesn’t actually get the full benefit of the insurance contract until the end of the six-month period. This transaction is recorded as a prepayment until the expenses are incurred. The same is true at the end of an accounting period. Only expenses that are incurred are recorded, the rest are booked as prepaid expenses.

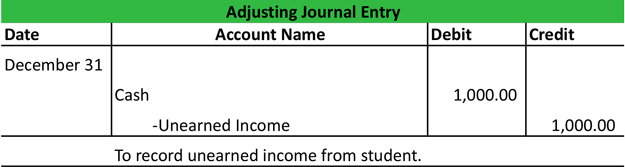

Unearned revenues are also recorded because these consist of income received from customers, but no goods or services have been provided to them. In this sense, the company owes the customers a good or service and must record the liability in the current period until the goods or services are provided.

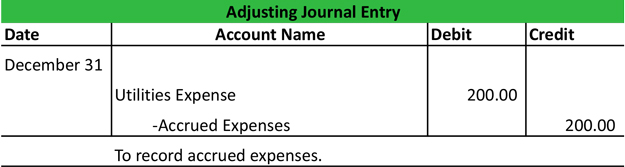

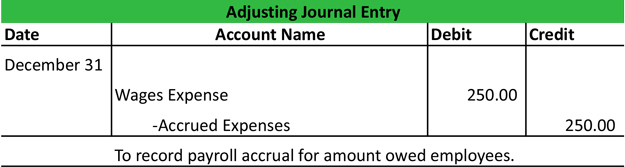

Accrued expenses and accrued revenues – Many times companies will incur expenses but won’t have to pay for them until the next month. Utility bills are a good example. December’s electric bill is always due in January. Since the expense was incurred in December, it must be recorded in December regardless of whether it was paid or not. In this sense, the expense is accrued or shown as a liability in December until it is paid.

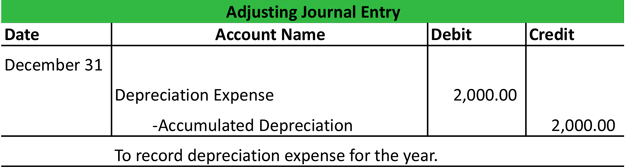

Non-cash expenses – Adjusting journal entries are also used to record paper expenses like depreciation, amortization, and depletion. These expenses are often recorded at the end of period because they are usually calculated on a period basis. For example, depreciation is usually calculated on an annual basis. Thus, it is recorded at the end of the year. This also relates to the matching principle where the assets are used during the year and written off after they are used.

How to Record Adjusting Entries

Recording AJEs is quite simple. Here are the three main steps to record an adjusting journal entry:

- Determine current account balance

- Determine what current balance should be

- Record adjusting entry

These adjustments are then made in journals and carried over to the account ledgers and accounting worksheet in the next accounting cycle step.

Example

Following our year-end example of Paul’s Guitar Shop, Inc., we can see that his unadjusted trial balance needs to be adjusted for the following events.

— Paul pays his $1,000 January rent in December.

— Paul’s December electric bill was $200 and is due January 15th.

— Paul’s leasehold improvement depreciation is $2,000 for the year.

— On December 31, a customer prepays Paul for guitar lessons for the next 6 months.

— Paul’s employee works half a pay period, so Paul accrues $500 of wages.

Now that all of Paul’s AJEs are made in his accounting system, he can record them on the accounting worksheet and prepare an adjusted trial balance.